Hearsay is pleased to provide this article on cross-examination. Whilst drafted with the conduct of criminal trials in mind, the salient principles essayed are equally apt to the conduct of civil trials. This article was assembled with contributions from the following members of the Queensland bar (in alphabetical order):

- Craig Eberhardt KC

- Angus Edwards KC

- April Freeman KC

- Andrew Hoare KC

- Saul Holt KC

- Jeff Hunter KC

- David Jones KC

- Elizabeth Kelso

- Mark McCarthy KC

- Tim Ryan KC

The time and input of such Counsel is greatly appreciated. We anticipate that it will provide a valuable resource to all barristers, irrespective of their level of experience.

For ease of reference the links to the earlier articles in Hearsay in this criminal law series are provided below, as is the mentioned video from Irving Younger – “Ten Commandments of Cross-examination” referred to by Ryan KC.

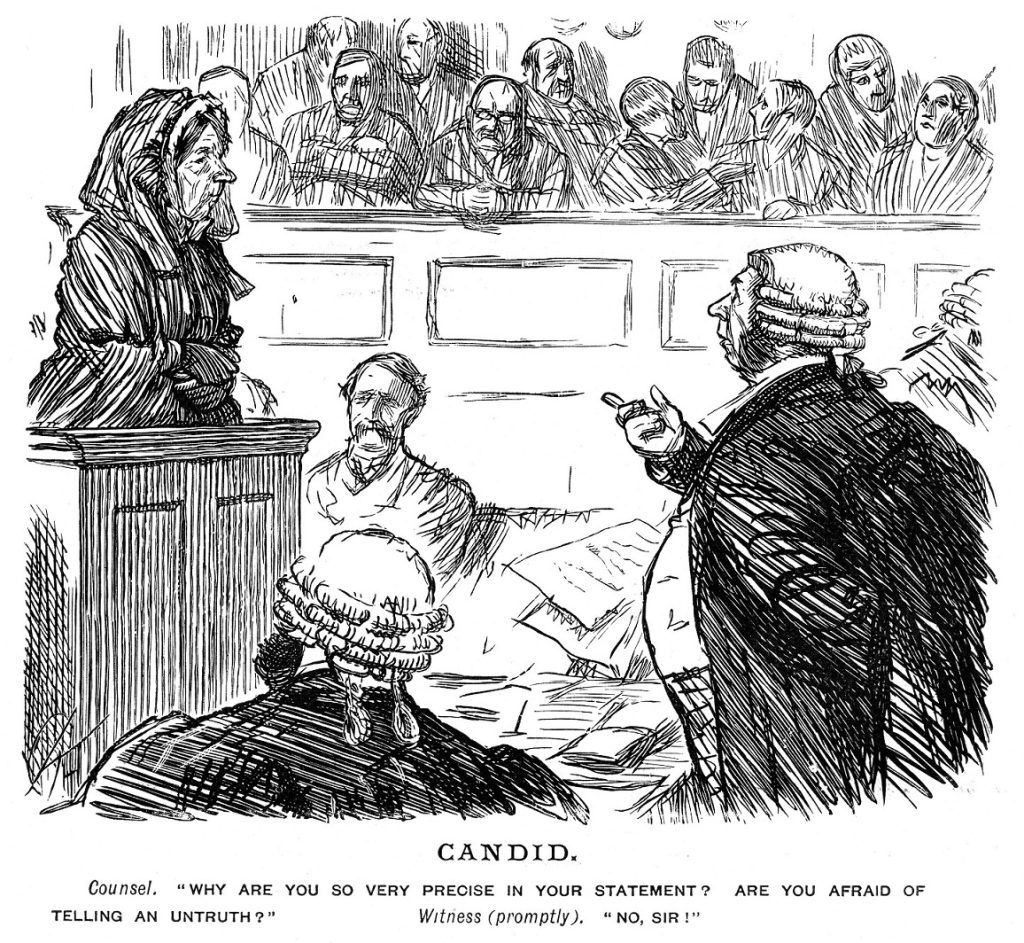

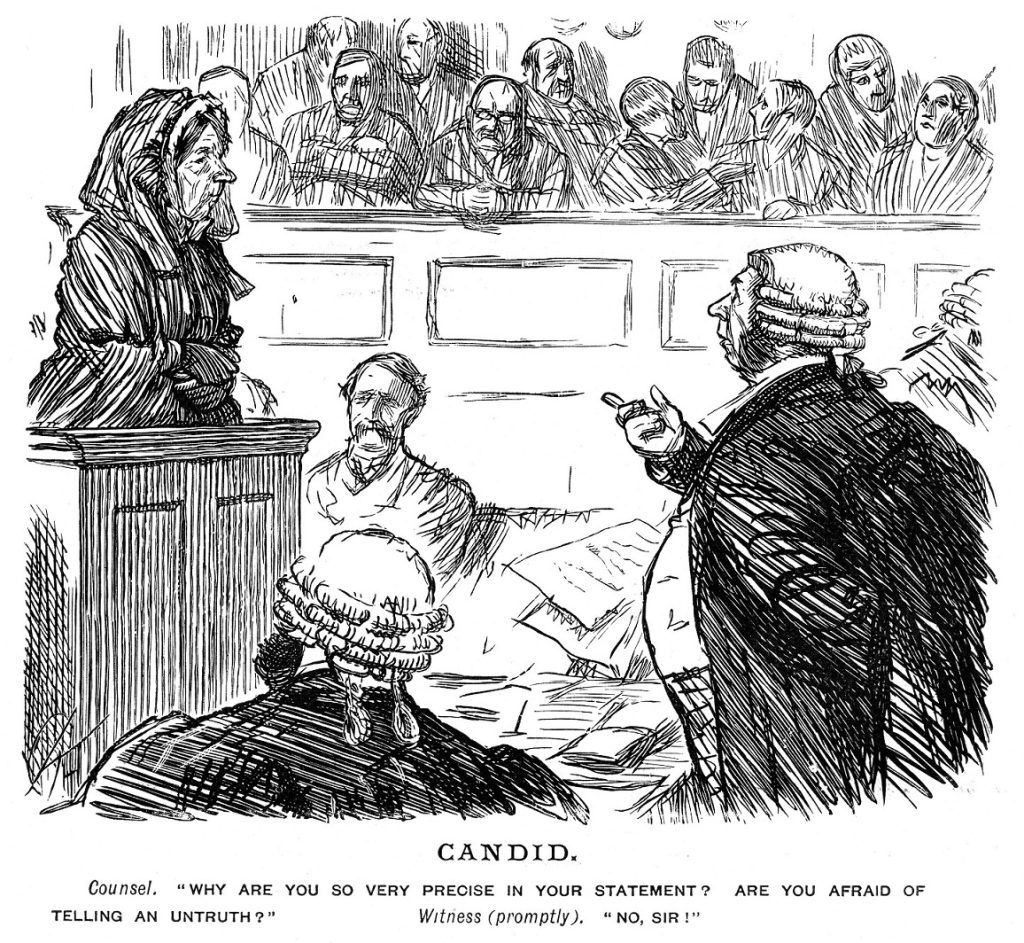

Cross-examination is a skill. It is a skill that requires time, patience, and a dedication to learning. There are several ways to develop your skills, such as reading transcripts or speaking with more experienced colleagues and asking for their advice. One of the best ways to develop your skills in the art of cross examination is to watch those who are great at it. Watching how a great cross examiner walks a witness down a path, not necessarily a path they want to go down, shutting each gate along the way. The witness ends up with only one path they can take, that the cross examiner has deliberately left open, securing the answer they wanted. Or, if the witness does not take that path then they look evasive or just plain wrong.

Mark McCarthy KC told us “Perhaps the best thing I can say is that reading about tips and techniques is essential, and must be done, but so is watching others cross-examine and thinking critically about what they do. And even more important is trying it out for yourself. Compare what you have read to what you see others do, then think about whether the things you have seen worked, or didn’t, and why. Was it execution, did it fit the witness, or the case? And then try it out for yourself. Do it in courses, in chambers, in silent mental preparation, and even by talking out loud to yourself (preferably while alone, or somewhere people will think you’re a busker and throw money). And in due course, when it suits you, use it in court. Learning how others cross-examine is fundamental. Applying that knowledge and developing what works for you is mastery”.

In that regard, Tim Ryan KC says you cannot go past American advocate Irving Younger and his ‘Ten commandments of cross-examination.’ “When I did the BAQ bar course they played Irving Younger’s video outlining his ten commandments of cross-examination and they remain the best guideposts to mould constructive cross-examination, whether you are just starting out or a seasoned advocate. The ideas Irving Younger has are communicated very effectively and should be revisited throughout your career. The best one is the admonition ‘what do you do when things are doing good, you stop. What do you do when things are going not so good, you stop’. The other person that people are less familiar with is American trial lawyer, Gerry Spence. Gerry Spence has never lost a criminal case and has written several books on advocacy, and in particular cross-examination. He continues to teach today, and his literature is well worth reading”.

Cross examination has several purposes:

- Establishing important facts helpful to your case that are not already in evidence.

- Confirming important helpful facts already in evidence.

- Bolstering the credibility of prosecution witnesses or defence witnesses who are helpful to your case.

- Impairing the credibility or reliability of witnesses who are not helpful to your case.

Those purposes are not mutually exclusive. It is possible, for example, to damage the credibility of a witness adverse to your case while still using that witness to establish facts helpful to your case. As defence counsel, securing evidence from a prosecution witness that helps your client can be particularly powerful for your case.

The key to an effective cross examination is to know exactly what you want to get out of the witness. Planning is important. During cross examination you want to control the narrative and elicit the information you require to incorporate into your closing address. A cross examiner should do everything that is necessary to advance the case theory and nothing that is not.

Craig Eberhardt KC shared this advice as to how he prepares for cross examination “[When] I start preparing cross examination of a witness, I assemble all of the statements, transcripts and exhibits relating to the witness’ testimony. Having all of the witness’ versions handy makes cross-referencing the material easier. I start by reading the witness’ versions (in the order in which they were given) and I make a numbered list of possible topics for cross examination references to the source material. As I read the material, I look for helpful evidence that I may get the witness to confirm.

I am also looking for inconsistent statements and/or inconsistencies between the witness’ evidence and the evidence of other witnesses and differences between the witness’ evidence and the objective evidence like photographs and video evidence. Once I have a list of all possible topics for cross examination for all of the witnesses I work out which topics I intend to cross examine upon. This step is the most difficult. Not all of the points you can make in cross examination will pull in the same direction. Work out the points you need to make and cull the rest.”

Your approach to a witness will depend upon what you want to achieve. Your approach may also depend on the impression you have gleaned of that witness’s personality during their evidence in chief and what impression you want the jury to leave with.

When you are reviewing the brief and you are presented with a witness who is damaging to your case you need to carefully plan your cross-examination. Think carefully about what you can establish through the witness that is helpful to your case? What parts of the witness’ evidence should be challenged? How might you damage the witness’ credibility or reliability?

The care required is best explained by April Freeman KC “It is critical in cross examination that every question you ask has a purpose and you know what that purpose is. If it doesn’t advance your case theory, then don’t ask it. This means that you have to have a clear idea of what your case theory is when you start preparing your cross examination. It also means that it is easy to then identify which witnesses you may not even need to cross examine, the topics and questions you may need to avoid and it also means you are prepared to readily answer any objections to your question – because you know what the purpose of it is and why it is relevant to the case. It is also important to remember that the question itself is not evidence, but rather the answer given, so if you are expecting a witness to adopt or agree with your proposition and it is important to your case, you need to think carefully about how you are going to frame or word the question, so that when the witness adopts it, you have the concession you need for your closing submissions at the end. For these types of questions, I often will write them out word for word so that I get it right when I am on my feet in court. A clumsily worded question which the witness then adopts may not in fact end up supporting your case when looked at in a transcript later on.

It also important to remember that you are not going to be great at cross examining witnesses straight away – it is a skill which requires practice, time and experience. So don’t beat yourself up if things did not go the way you had imagined or hoped. We all have bad days in court. The important thing is to recognise where you went wrong and how you might be able to improve things for next time. Advocacy is a continual learning process.”

If a witness is helpful to your case, there is no point in damaging their credibility. A better approach would be to simply lead the witness carefully to establish or reinforce the helpful facts you want.

The order of your questioning will be important in achieving your purpose. You should have a case theory, consistent with your instructions or in proving the elements of the offence. Consider how you can use the order of your cross-examination topics to develop that case theory. Remember, the most important people in the room are your jury. You want them to follow your narrative so they can apply it in your favour, and you do not want them to feel you are being deliberately confusing or unfair to the witness.

Having said that, Saul Holt KC offers this advice when preparing your questions. “It took me ten years to learn that writing out my questions in cross examination was totally counterproductive. It created a straight jacket from which I couldn’t escape when – as often happens – the witness struck a different tone to that you were expecting, or came into a proposition much more readily than you thought they would, or fought back on something surprising. Instead, my notes are of the key facts, propositions and prior statements of the witness that are relevant to particular topic I’m exploring. Letting go of the crutch of written out questions was terrifying but freeing. The other thing I wish I’d been told was to never, never never (never) start with the ultimate proposition you want to put to the witness. That always comes last (if you need to do it at all) after you have built and built and built all of the steps to make the proposition impossible to deny. Putting something to a witness and then fighting them about it for 10 minutes is never as effective.”

This, of course, is much easier when you have a cooperative witness because you can get straight to the point.

You had been drinking heavily? – YesYou were a hundred metres away from the fight?- YesYou were not wearing your glasses?- No I wasn’t.It was dark?- YesThe lighting was very poor?- YesFor all of those reasons you did not have a good view of the fight?- CorrectAnd for that reason it is possible that you did not see everything that happened at the start of the fight?- Correct

With a difficult witness you have to take a different and more disciplined approach, particularly if you think the witness may try to work out where you are going and change their evidence to head you off. With this type of witness you need to tread cautiously and carefully, establishing all of the subordinate facts and circumstances before tackling the contentious parts of the witness’ evidence or putting a proposition that you know the witness wants to disagree with. You should be careful to maintain control of your witness. This is much easier in cross examination than evidence in chief, because your questions should generally be leading, propositional and only contain one such proposition per question. Limit the use of “tag ons” like “I put it to you that”, or “I suggest that” or “that’s true isn’t it”. “Tag ons” limit your flow and your control. Try getting rid of them and feel the difference it makes.

Angus Edwards KC offers this advice “Most trials come down to a handful of witnesses, sometimes less than that. Cross-examination of the remainder should usually be conducted with a scalpel, get what you need and get out. Of the witnesses that really matter, for my part it’s the same, get what you need and get out, but that means something different for those important witnesses. Sometimes what you need is to expose problems with credibility or reliability and that might not be neat and straightforward. For those witnesses, have a plan but don’t follow a script, and if you have a script listen to the answers and be prepared to go off script. Be prepared to follow a witness where they go. Some of the most devastating cross-examinations come in the most unexpected of ways, so be plastic and mould your cross-examination to the moment rather than to a preconception. That gets easier with experience. When you are starting out though, the things you really want to cross-examine about are the things you want to talk about in your closing address. Cross-examination of key witnesses is, in many ways, just the first time you give that address, only you give it in questions rather than a soliloquy. Your questions should contain all of the things you want to say in your address.”

When your case is that a witness is lying you need to discredit him/her early in your cross examination to erode any favourable impression he/she has made on the jury. You may wish to draw out biases, prior criminal convictions, has colluded with other witnesses, a motive to lie and significant prior inconsistent statements are all good places to start.

If you have objective evidence that demonstrates the witness is mistaken or being dishonest then use that to your advantage. Lock the witness into their current version before taxing them with their earlier inconsistent version or showing them CCTV footage that shows something different to their account.

Andrew Hoare KC said:

“Do not blindly follow a myopic path when cross-examining. You need to be suitably empathic to not just what is being said but the way it is being said. Often you approach a witness with pre-conceptions of their personality due to the content of their evidence. You must be prepared to alter your tone of questions when it is apparent those pre-conceptions are misplaced. Some witnesses will naturally evoke sympathy in the minds of the jury but that does not mean you cannot draw from those witnesses’ appropriate concessions. Every cross-examiner has a different style, and I don’t suggest that there is any single correct approach. I try to be courteous as far as I can be, even in the face of discourtesy. Be acutely aware of the mood of the courtroom and in particular the jury. In that context, do not raise your voice at a witness unless the witness has not answered a clear question asked in a clear way and also, critically, you feel the jury have lost their patience with that witness. Approaching your cross-examination in that way makes you an ally of the jury and not their opponent. That will advance your client’s case.”

A message to prosecutors. Cross-examination is incredibly unlikely to elicit a confession to the crime you are prosecuting. You may not have a proof of evidence from the accused, but you will know what their evidence is likely to be from the cross examination of the prosecution witnesses, particularly the complainant. Prepare, and consider what is your purpose, for example are you looking to establish opportunity, lies, inconsistencies or motive. Always assume you may need to cross examine an accused and know what you need to cross-examine on to ensure that any propositions you wish to make in closing submissions are covered.

Before you embark on cross-examination you need to understand the rules of evidence. For example, learn how to properly cross examine on a prior inconsistent statement. Your questions can be pressing or persistent, but they should be relevant to an issue or to credibility and not prohibited by law. You should familiarise yourself with sections 15 to 21 of the Evidence Act 1977 (Qld). Make sure you comply with your obligations under Browne v Dunn (1893) 6 R 67. But, where possible, integrate what you need to put to a witness as part of the general flow of cross examination, rather than adding it on at the end.

If you are getting a hard time about the relevance of your cross-examination, Jeff Hunter KC says this is an example of where the law is your friend. Look to Wakeley & Bartling (1990) 93 ALR 79, 86, where Mason CJ, Brennan, Deane, Toohey and McHugh JJ said:

The limits of cross-examination are not susceptible of precise definition, for a connection between a fact elicited by cross-examination and a fact in issue may appear, if at all, only after other pieces of evidence are forthcoming. Nor is there any general test of relevance which a trial judge is able to apply in deciding, at the start of a cross-examination, whether a particular question should be allowed. Some of the most effective cross-examinations have begun by securing a witness’ assent to a proposition of seeming irrelevance. Although it is important in the interests of the administration of justice that cross- examination be contained within reasonable limits, a judge should allow counsel some leeway in cross- examination in order that counsel may perform the duty, where counsel’s instructions warrant it, of testing the evidence given by an opposing witness. Lord Hanworth MR, in words which commanded the approval of the House of Lords in Mechanical and General Inventions Co and Lehwess v Austin and Austin Motor Co Ltd [1935] AC 346 at 359 , said:

Cross-examination is a powerful and valuable weapon for the purpose of testing the veracity of a witness and the accuracy and completeness of his story. It is entrusted to the hands of counsel in the confidence that it will be used with discretion; and with due regard to the assistance to be rendered by it to the court, not forgetting at the same time the burden that is imposed upon the witness.

What do you do once you have achieved your purpose in cross examination? Sit down. When you are questioning a witness, and everything is going your way, sometimes as an advocate it can be hard to stop and be quiet. But there is nothing more dangerous to your case than going that one question too far. If you have all the answers you need, you have done your job. Stop. Often the most powerful cross examination is no cross examination at all. If you have everything you need from a witness’ evidence in chief, the only thing you risk doing is making it worse.

For those who are starting out, David Jones KC offers this guidance “If you are new to advocacy, know that there is no singular correct approach to cross- examination. Each advocate will develop a style that will suit their personality. That style will then mould to their environment, their opponent, the witness or even their solicitor’s client. In my experience, the days of barristers only having the one ‘gear’ whereby they shout and intimidate the witness has come or is coming to an end. Our Judges appear to be less tolerant of this approach, and more importantly, our jurors appear, except for the infrequent ‘deserving’ witness, to be unimpressed when such a course is taken. My first point of call is to settle the case theory and have an advanced draft of your closing address before you start preparing for cross-examination. This, in my opinion, is a must. Putting aside opportunistic targets, having both will provide you with a clear path to cross-examination. My next point is brevity.”

You will get better at cross examination with experience, but experience and skill are no substitute for careful preparation and planning. Good preparation will help reduce your nerves, allow you to maintain control of your witness and will give the impression to everyone that you are prepared, organised and that you know your case back to front. Ultimately that is your goal, so the jury can trust what you are telling them in your closing address, supported by the evidence you require.

After every cross examination force yourself to go through the painful process of reading the transcript and working out what worked and what didn’t.

And importantly, take every opportunity to go watch some great cross examiners in court!

The Acceptance and Initial Management of Criminal Briefs – Issue 93 September 2023Objections in Criminal Trials – Issue 94 December 2023Opening Addresses in Criminal Trials – Issue 95 March 2024Evidence in Chief in Criminal Trials – Issue 96 June 2024Maintaining your Selfcare During Trial – Issue 97 September 2024

Although we highly recommend that you do view it, for those members who presently do not have time to watch it – in summary Irving Younger’s 10 commandments on cross examination are:

- Be brief

- Use plain words

- Use only leading questions

- Be prepared

- Listen to the witnesses’ answers

- Do not quarrel with the witness

- Avoid repetition

- Disallow witness explanation

- Limit questioning

- Save the ultimate point of your cross for your closing argument

Ms Amanda O’Brien, Principal Registrar – Supreme, District and Land Courts Service, obtained a Bachelor of Arts (Justice Administration) from Griffith University in 1996, and a Bachelor of Laws from the Queensland University of Technology in 2002. She was admitted to practice as a solicitor on 28 January 2003.

Ms O’Brien’s career in legal administration commenced in 1989 with her appointment as Deputy Registrar and Deputy Sheriff of the District and Magistrates Court registries at Southport and Beenleigh. Since that time she has served in a raft of roles, including:

- 2005 to 2013 – Manager and Senior Legal Research Officer, Queensland Sentencing Information Service, Brisbane.

- 2014 to 2015 – Legal Practice Manager, Office of Director of Public Prosecutions, Cairns.

- 2016-2017 – Senior Registrar, Magistrates Courts’ Service, Brisbane and Cairns.

- 2017-2024 – Deputy Principal Registrar and Sheriff of Queensland, Brisbane, Supreme, District and Land Courts’ Service.

- September 2024 to date – Assistant Director-General of the Department of Justice and Attorney General, and Principal Registrar, Supreme, District and Land Courts’ Service.

Ms O’Brien chatted with editor, Richard Douglas KC.

Douglas

Thank you for speaking with Hearsay.

O’Brien

It’s an honour, but I’m conscious I follow some very eminent interviewees.

Douglas

Congratulations on your recent appointment to your role. You succeeded the highly regarded and long serving Julie Steel PSM on her retirement. Did she serve as a role model for you?

O’Brien

Thank you. When I started in the Southport Courthouse over 35 years ago, I’d never have imagined becoming the Principal Registrar. Julie was a brave and innovative leader and is a hard act to follow. Even though she has left the workplace, we remain great friends. We worked together for many years, so no doubt some aspects of my leadership style will reflect Julie’s, but I can see the influence of several past leaders and mentors. My Dad is probably my greatest role model. He recently passed away and as I sit here, I reflect on what a great humanitarian he was. He taught me to work hard, be fair, be compassionate and strive for the greater good.

Douglas

Are there different issues to be addressed across the three courts you administer?

O’Brien

Many issues are similar across any court but yes, each Court has nuances that need to be considered, both day to day and in the long term. I’m fortunate to have very supportive Heads of Jurisdiction and a very talented team around me.

Douglas

Are challenges spawned for court administration by dint of Queensland’s decentralised character?

O’Brien

Most definitely. My core role is to deliver high quality Supreme, District and Land Courts’ registry services across the State. What works well in QEII in Brisbane may not necessarily work as well in Cairns or Roma. There’s a great challenge in ensuring the same level of service is delivered, regardless of location, and every change to registry process is always approached from ‘how would this work in a regional location’. But over the last several years, we’ve worked hard to develop ways to meet these challenges. For example, with our jury services, we have a dedicated team in Brisbane that supports our regional colleagues. Each regional location maintains their own discretion, but Brisbane is there to assist. It promotes consistency and supports our regional colleagues, some in small and remote registries. This type of model is made easier as we roll out more contemporary case management systems.

Douglas

You were at “ground zero” during court restrictions caused by the Covid epidemic. Did that experience ultimately enhance efficient and effective registry practice?

O’Brien

As your members would be aware, running courts each day is a major logistical exercise with many, many critical parts and people. When it all stops, it does make you look at existing processes. We needed to quickly deconstruct and redesign processes we’d been following for years. Technology certainly generates a lot of innovation. It’s an excuse to think outside of the box. We worked with the Judges to develop a COVID safe jury trial and the registry implemented very simple innovations, such as the ‘drop box’ way of filing documents. We also developed an electronic way of filing Applications for Probate. It was a little clunky, but the uptake was amazing. Learnings from these days are still being applied and again, our Heads of Jurisdiction are always part of these discussions. I am very grateful to registry staff who each remained so committed through that difficult time. They came to the registry each day to perform the work they knew was so important to the people of Queensland. It was the great unknown for all of us, but looking back, I can say I am proud that our services kept being delivered, despite the challenges we faced.

Douglas

What are the principal issues on the agenda in transformative change in registry operation and performance?

O’Brien

I think for my tenure as Principal Registrar, the main area of transformation is going from paper to digital. The transition has well and truly started, but there’s still a lot of work to do. It’s not as simple as an IT person building a system. There is so much work in ensuring the registry is ready – that’s our processes, our staff’s capability, meeting the needs of courts users, both the profession and self-represented people, and ensuring ‘digitisation’ doesn’t inadvertently leave some members of our community unable to access our services.

Douglas

I note that electronic filing has been introduced in the conduct of succession causes. What timeframe is envisaged for electronic filing in other litigious spaces?

O’Brien

Between now and mid-2026, we will be developing an electronic civil case management system. Early systems, such as the Wills and Estates System, allow us to validate and refine our business process. Going from an entirely paper based way of doing business to electronic, is a fundamental change to how we operate and interact with our judiciary and court users.

Douglas

You lead close to 300 full-time equivalent staff. Do you encounter difficulty in retaining staff to deploy in service provision?

O’Brien

We’re probably not alone in the ongoing challenge to retain staff. When I first started in courts, it was a job for life, but the world has changed. We know that people are now more inclined to have multiple careers due to a variety of factors including the desire to explore different industries and to improve work-life balance. It’s the reality of our modern workforce. A few years ago, we developed a model of professionalism which is premised on the fact that, by working in courts, you develop a wealth of knowledge or expertise in registry operations. It was stating the obvious, but often we need that stated to better appreciate the importance of the work we do. I see registry staff demonstrate their commitment to professionalism each day. They know their work is important in delivering justice services to the people of Queensland.

Douglas

You are a long qualified solicitor, as are a number of your registry staff. Which registry service roles are assisted or informed by legal qualification and experience, and why is that so?

O’Brien

Certainly, in the Principal Registrar role, having a legal qualification is a huge assistance to me, as is my court experience. The registry landscape was always highly regulated, but over the last several years, the services delivered by registry have evolved and require additional skills and experience. One of the more recent evolutions in service delivery was the introduction of Resolution Registrars. Currently there is one in Supreme Court civil and one in Supreme Court criminal. Both roles involve regular dealings with parties, legal representatives, and judiciary. I think to be effective, the services must be delivered by someone with the relevant professional background. This gives the role the standing and gravitas to work with the parties and achieve results. There are many legally qualified registry staff who continue to make registry and courts administration their career. It’s hoped that most of these very talented individuals will stay with us and be the leaders of the future.

Douglas

Are there any registry service attributes adopted interstate, or overseas, which are worthy of consideration for introduction in Queensland?

O’Brien

Over the years, we’ve visited the courts of other Australian jurisdictions to share learnings and identify opportunities. Most if not all jurisdictions have embraced electronic management of court documents and fortunately, we’re on that journey. Digitisation remains the key to unlocking so many benefits for our court users, staff and judiciary. Certainly for the next few years, the transition to digitisation will remain my focus.

Douglas

The Queen Elizabeth II Law Courts Complex in Brisbane is only 13 years old, but other principal registries in regional Queensland were built 30 to 40 years ago. Do their “as built” attributes present any challenges to future registry performance or transformation?

O’Brien

Many of these buildings are simply beautiful, rich in history and built in a style of a bygone era. But there is no doubt that many regional courthouses present challenges with delivering contemporary court services. The obvious challenge is installing technology. You can’t just lift up a floor panel to lay cabling for technology and you can’t just knock a wall down to make a courtroom larger. We are fortunate that over the years our very clever Courts IT and Department of Justice infrastructure teams have developed and delivered some impressive outcomes which have contributed to delivering contemporary practices in areas including supporting remote appearances and taking evidence of vulnerable witness.

Douglas

How do you envisage the Supreme, District and Land Court registries operating in 2050?

O’Brien

So much has happened over the last 25 years, both in courts and generally. I’d fully expect that paper will go the way of the cassette tape or Beta video. I’d see our systems and processes being far more integrated and our staff having entirely different capabilities. But I don’t see advances in technology removing the importance of having registry staff as a critical part of the business. Every matter coming before the court impacts people. We will always need dedicated, impartial, trauma informed registry professionals delivering services to court users.

Douglas

How can the practising profession – in particular barristers – better assist the registries in discharging their role?

O’Brien

I’m pleased to say that our registry staff consistently receive strong support from your members. We all operate in a fast-paced and sometimes hectic environment. As we transition to digital processes, we kindly ask for your members’ patience and collaboration as we adapt to these new ways of working. This journey requires some understanding as we navigate the challenges that come with such significant changes. However, based on my many years of experience, I can confidently say that your members have always been supportive of the registry. The partnership we share is truly unique and I’m sure our good relationships will continue.

Douglas

What are your recreational interests outside your busy work schedule?

O’Brien

My family and friends are my world outside of work and I love to feed them. Some find it stressful, but I really enjoy the ritual of preparation. Mirepoix* is my meditation. I am also quite good at growing orchids but I am not sure whether that is luck or talent.

Douglas

Thank you for speaking with Hearsay.

O’Brien

It’s been a pleasure. Thank you.

*According to Wikipedia: mirepoix (/mɪərˈpwɑː/ meer-PWAH, French: [miʁ.pwa] ) is a mixture of diced vegetables cooked with fat (usually butter) for a long time on low heat without coloring or browning. The ingredients are not sautéed or otherwise hard-cooked, because the intention is to sweeten rather than caramelize them. Mirepoix is a long-standing part of French cuisine and is the flavor base for a wide variety of dishes, including stocks, soups, stews, and sauces.

In “Good Barristers; Bad Days”, PA Keane AC KC, in an address to Queensland Bar Practice Course, 28 May 2015, at 7, said:

One of the most misleading clichés which you will hear about advocacy is the phrase “Keep it simple, stupid.” The reason for having barristers at all is that it is not simple. The task is not to keep it simple; but to make it simple. And that is hard.

Michael McHugh QC, himself one of the legends of the Australian Bar, has observed that the secret of Sir Garfield Barwick’s success as Australia’s pre-eminent advocate lay in his ability to simplify what was complex and to illustrate an abstract proposition with a concrete example. This is the quintessential skill of oral argument.

The skills of refinement, simplification and synthesis that we value most highly in our advocates have been developed over the course of a millennium in oral argument in court or in mooting in the Inns of Court, rather than in the marshalling of citations from academic treatises. That is no less true today than it was in the time of Edward I.

But the exercise of these skills is harder for barristers today than ever before because our confident and rights-conscious fellow citizens who will be your clients, and the commercially savvy solicitors who will be briefing you, will often bring moral and economic pressure to bear on you to pursue every possible point regardless of your view of its merits or lack thereof. It is part of your job, perhaps the hardest part, to counsel your clients and your solicitors against what will appear to the court to be a wasteful self-indulgence. You will need to be brave. You might lose the support of some solicitors as a result, but you will, in the long run, be, and be seen to be, a better barrister for it. The courts will be better for it too. And you will impress the judges and others.

(emphasis added)

12 McHugh, “The Rise (and Fall?) of the Barrister Class” in Gleeson and Higgins (eds), Rediscovering Rhetoric: Law, Language and the Practice of Persuasion, (2008) 165 at 189.

Emma Coulter is a visual artist, living and working in greater Melbourne. Born in Northern Ireland, Emma grew up in Brisbane, Queensland (mostly), until she relocated to Melbourne in her late twenties.

Practising as a visual artist for over twenty years, Emma also has a background working in interior architecture. One of the key projects she led was the design for a 14000m2 office fit out for Allens Law firm, at 101 Collins Street in central Melbourne.

Having studied straight from school, both a Bachelor of Visual Arts, and a Bachelor of Built Environment at QUT, Emma worked for many years in both fields, before making the leap of faith in 2014 to quit her serious day job, and undertake a Masters at the Victorian College of the Arts in Melbourne. It was during this time that her painting practice, and deep knowledge in architecture and space collided to create a new ongoing series of site-specific works, named, ‘spatial deconstructions’. Painted in situ, these works took the elements of each space as a canvas for a painting. It was during this time that she started to refine her colour palette, creating a series of colours, that could be taken across painting, installation and sculpture.

spatial deconstruction #23 (resilience), 2021 to 2023 – CITY SQUARE, Melbourne, Australia

Since then, Emma has created over 30 site-specific installations, including 10 major public art commissions. Significant public art projects include, Yarrila Place, Coffs Harbour, (2023); Shepparton Art Museum, (2023); City Square, Melbourne (2021); Footscray Community Arts Centre, Melbourne (2021), QUT Art Museum, Brisbane (2021) and William Jolly Bridge (2020).

In 2019, Emma was invited to make a site-specific work at the Museum of Brisbane, for a retrospective exhibition, titled, ‘NEW WOMAN’, a centenary exhibition celebrating the work of ‘ground-breaking female artists’, of a Brisbane origin. Through the process of being included with a major commission in this exhibition, (her work filled an entire room in the museum, which at the time was the largest work she had ever made), she was then invited to create the work for the William Jolly Bridge by the curatorial team at the Brisbane City Council.

spatial deconstruction #21 (portals), 2019 to 2020 – Commissioned for ‘New Woman’ at Museum of Brisbane, Brisbane, Australia.

multichromatic synaesthesia, on the William Jolly Bridge, celebrates the movement of the city, and the river, whilst deconstructing the unique form of this civic heritage structure, during night fall, and the shared non-hierarchical public space of the William Jolly Bridge. Utilising a study for a painting, and her serial colour palette, and the tools of light projection, the bridge was transformed into an ephemeral site-specific light intervention.

For around ten years, from 2010 to 2020, the Brisbane City Council ran an initiative to highlight the historical and iconic structure of the William Jolly Bridge, by transforming it into a large-scale temporary public artwork celebrating artists and cultural events around the city.

The William Jolly Bridge projection was one of Emma’s first (paid for) public art commissions. Through the transformation of the bridge, as a canvas for Emma’s work, at this great scale, she was able to break into the public art realm to be shortlisted for more commissions. The breakthrough work demonstrated the potential for Emma’s work to transform public spaces into multichromatic interventions, celebrating, colour, light and space.

In 2020, Emma was shortlisted and won the commission to transform a building occupying a whole city block in central Melbourne, whilst the construction for the new Metro tunnel stations were under way. The following year she was also awarded a competition to create a new work on Footscray Community Art Centre’s façade, as part of the Footscray Art Prize. Other additions to the urban environment, include an enormous multi sided artwork on a construction site in South Melbourne, a public mural in Malvern East, a streetscape intervention on Richmond Town Hall’s facade, a public facing window intervention at QUT Art Museum, as well as a spatial deconstruction work in Burnett Lane, Brisbane CBD.

In 2023, Emma completed her first integrated, site-specific, light and sculpture commission, ‘let them feel the light’, at Yarrila Place, Coffs Harbour’s new civic and cultural centre, in NSW. Being shortlisted through national callout, Emma was awarded the commission through her winning concept design proposal. Emma worked on the development of this project for over two years.

Existing at the heart of the building, the work traverses the light filled atrium space, dispersing colour and illumination, in acknowledgement of the meaning of Yarrila, whilst also drawing inspiration from Coffs Harbour’s geographic coastal location. Through her voice as an artist these ideas intersect with concepts of memory, time and feeling to culminate into a unique site-specific work. It is her most significant public art work to date.

let them feel the light, Emma Coulter, 2023 – Yarrila Place, Coffs Harbour Cultural Centre, Gumbaynggirr country, New South Wales

When she is not working on big public art projects, you can find Emma in her studio working on smaller scale paintings and sculptures. Alongside her larger scale public works, she regularly exhibits work in both solo exhibitions and invited group shows. Her work is held in the permanent collections of Artbank, the City of Melbourne, QUT Art Museum, the Australia and New Zealand Banking Group, St John of God Healthcare, and private collections here and overseas.

Emma’s works have also been exhibited internationally, in both Germany and New York.

Emma is currently working on her next solo exhibition, SUPERIMPOSITION, which will run from 3 – 24 May, at James Makin Gallery in Melbourne.

If you are interested in finding out more about Emma Coulter, you can view her website at www.emmacoulter.com.au or contact her gallery at info@jamesmakingallery.com

The title of this item is a quote from Starke J, in dissent, in a decision of the High Court 90 years ago in Ramsay v Aberfoyle Manufacturing Co (Australia) Pty Ltd (1935) 54 CLR 230 at 253. The full quote is as follows:

Courts of law, however, can only act upon the law as it is, and have no right to, and cannot, speculate upon alterations in the law that may be made in the future.

Starke J’s adjuration was followed by Lockhart and Gummow JJ, in the Full Court of the Federal Court, in Attorney General (NT) v Minister for Aboriginal Affairs (1987) 16 FCR 267 at [50], [51]. The issue invariably arises in circumstances in which there has been an announcement by government, at some level, of the prospect of legislative amendment, likely of retrospective operation, which would impact upon the subject matter.

Instructive in this regard is the decision of the New South Wales Court of Appeal in Meggitt Overseas Ltd v Grdovic (1998) 43 NSWLR 527, in particular in the judgment of Mason P. Instructive also are the reasons for judgment of McHugh J, sitting as a member of the New South Wales Court of Appeal, in Sydney City Council v Ke-Su Investments Pty Ltd (1985) 1 NSWLR 246 at 258, quoting R V Whiteway; Ex parte: Stevenson [1961] VR 168 at 171.

The authorities concerning the principle were collected, and application thereof exemplified, in the recent decision of Forbes J in Taylor v Trustees of the Christian Brothers [2025] VSC 25 (4 February 2025). Her Honour wrote:

[1] The plaintiff has made an application to vacate the trial listed for 11 February 2025. The application was returnable at the final directions hearing on 31 January 2025. It was opposed by the defendant.

…

[5] Given the absence of formal applications in either matter and the concession of the parties that both matters could be determined prior to the present trial date, the application to vacate rested on the proposed legislative changes in relation to vicarious liability.

[6] The plaintiff’s affidavit in support deposed to a question asked of the Victorian Attorney-General in Parliament on 26 November 2024 as to whether she would actively support legislative reform following the High Court decision in Bird: Plaintiff, ‘Affidavit of Shea Rowell’ affirmed 30 January 2025, Affidavit in Taylor v Trustees of the Christian Brothers [2025] VSC 25, (‘Plaintiff’s affidavit in support’), [22]. In response, Ms Symes indicated that ‘the Standing Committee of Attorneys-General [had met] on Friday, where I raised this matter…I have been tasked with leading the work on bringing some material back to that committee; we meet in February [2025]’: Ibid, extract of the Hansard, Legislative Council, on 26 November 2024, as exhibited to the Plaintiff’s affidavit in support, 26. Other correspondence and news articles from December 2024 were also referred to and exhibited. The proposed legislative amendments were submitted to establish a particular injustice to the claim of the plaintiff which would also affect others matters in the Institutional Liability List. An adjournment to a date not before 1 July 2025 was sought.

[7] There is a long line of authority establishing the general principle that the role of the Court is to determine cases according to the existing law. The comments apply whether the contemplated changes derive from a court appellate process or a legislative process. In Meggitt Oversesas Ltd v Grdovic (1998) 43 NSWLR 527, Mason P found that a trial judge had erred in vacating a trial so that a plaintiff could rely on proposed legislative changes to reform available damages for dust diseases. It was argued that proceeding to trial before the foreshadowed amendments would seriously prejudice the plaintiff. In finding that the trial judged had erred in exercising this discretion, his Honour said (Ibid 529, Sheller and Beazley JJA agreeing.):

In my view, the discretion miscarried. The learned judge erred in taking into account the prospect of legislative amendment as a controlling factor in the decision granting the adjournment. The error was compounded by the apparent intent that the hearing date will, as presently advised, be deferred until the amending legislation is passed and the plaintiff becomes thereby entitled to take advantage of it.

[8] The announcement of a decision to introduce particular legislation, and any retrospective operation of such legislation, may impact pending proceedings. But, as Mason P went on (Ibid 531):

Does the announcement qualify in any way the judicial branch’s obligation to uphold the existing — I emphasis the word ”existing” — law? And does it enliven a power to grant a contested adjournment of proceedings fixed for hearing so as to enable one party to gain the benefit of proposed legislation to the detriment of another party? The answer to each question must be a categorical “no”.

[9] These comments in turn relied on a line of authority based upon the comments of Starke J (Ramsay v Aberfoyle Manufacturing Co (Australia) Pty Ltd (1935) 54 CLR 230 at 253; see also as applied in Attorney-General (NT) v Minister for Aboriginal Affairs (1987) 73 ALR 33 at 50 –51, Jupp v Computer Power Group Ltd (1994) 122 ALR 711, Sydney City Council v Ke-Su Investments Pty Ltd (1985) 1 NSWLR 246, McHugh J at 258 quoting R v Whiteway; ex parte Stevenson [1961] VR 168 at 171):

Courts of law, however, can only act upon the law as it is, and have no right to, and cannot, speculate upon alterations in the law that may be made in the future.

[10] At present there is no Bill before the Victorian Parliament. The Victorian Attorney-General said in the Victorian Parliament on 26 November 2024, legislative amendments are complex and involve considerations of federal laws and retrospectivity, amongst other things. There is a need to consider unintended consequences, and consultation with stakeholders will be required (Plaintiff’s affidavit in support, 26). The effect of proposed legislative change on any individual case is presently speculative.

[11] Since the trial judgment in Bird, delivered on 22 December 2021, cases in the Institutional Liability List have continued to be determined, pending the appeals to the Court of Appeal and then to the High Court in accordance with the law as it stood from that time: DP (pseudonym) v Bird [2021] VSC 850. This is in accordance with the general principle that cases are not delayed because the outcome of a prospective change in the law might have a bearing on the outcome of a particular trial. As Ormiston JA said in Geelong Football Club v Clifford (2002) VSCA 212, [6]-[7], Callaway JA agreeing:

It is not ordinarily sufficient to show that an appeal yet to be heard in another case may reach a legal conclusion which could support the claim made by the party seeking the adjournment. Of course there are no black and white rules preventing adjournments in appropriate circumstances. …

Generally speaking, however, a possible change in the law, whether judicial or legislative, is not to be treated as justification for failing to hear a case fixed and ready for trial.

[12] The general principle may be displaced in an appropriate case. The plaintiff did submit that an injustice would arise because of how the plaintiff intended to put his case at trial. As articulated, this injustice arose because of how the pleadings dealt with the role of Brother Webster against whom abuse is alleged and who was the school principal at the relevant time. The plaintiff submitted that the potential exclusion of liability for Brother Webster’s acts or omissions as principal warranted an adjournment. Whatever the particular factual circumstances, the change to come from potential legislative change remains a matter of general application to many cases. The plaintiff accepted a significant number of pending cases are likely to be similarly impacted by the decision in Bird. I do not accept that this was a basis upon which I ought adjourn this particular trial.

…

(emphasis added)

A link to the full decision may be found here.

In Sanmik Food Pty Ltd v Alfa Laval Australia Pty Ltd [2025] NSWCA 7 (10 February 2025), the New South Wales Court of Appeal addressed the proper construction of a release clause in a settlement deed in relation to the status of certain equipment. The initial contract between the vendor and the purchaser concerned the sale of two coconut milk production plants, comprising various components, including the subject homogeniser and aseptic filler equipment. The vendor shipped the equipment to the purchaser in Sri Lanka, but no further components were shipped. Initial proceedings were settled, under a settlement deed, which provided for “a new supply [of two plants] that is independent of the previous contract”, and released the purchaser “from all Claims and actions arising from or in connection with the Settled Matters”. The settlement documents were silent on what was to be made of the equipment already delivered. The purchaser then commenced a proceeding alleging that on the proper construction of the settlement deed, the vendor was not entitled to use the equipment previously supplied to discharge any part of its obligation to supply two plants under the deed. The primary judge dismissed the purchaser’s claim, and an appeal (Adamson JA dissenting) was dismissed. McHugh JA, and Griffiths AJA, wrote:

[108] The parties chose to settle litigation about their Initial Contract for the supply of two plants, which contract they agreed had been terminated, by entering into a new contract for the supply of two plants. The parties failed to make express provision in the Settlement Documents for the fact that, prior to termination of the Initial Contract, the vendor (a) had delivered to the purchaser a homogeniser and filler that would meet the specification for the same components of the plant required to be supplied under the new contract, but (b) retained title to those components. That failure made it, as Adamson JA points out, almost inevitable that the Settlement Documents would require judicial interpretation.

[109] Having had the considerable benefit of reading Adamson JA’s reasons for judgment in draft, and gratefully adopting her Honour’s abbreviations, I can express my reasons for concluding that the appeal should be dismissed relatively shortly. Although I am in general agreement with Griffiths AJA, I would add the following.

[110] Neither party suggested that the fact that the homogeniser and filler were physically located in Sri Lanka had any bearing on the applicable principles; they proceeded on the footing that the general law of Australia applied.

Title to the homogeniser and filler at the time of the settlement

[111] It was common ground at first instance and on appeal that the vendor retained title to the homogeniser and filler immediately prior to entry into the Settlement Deed, and that there had been no dispute about the vendor’s ownership of the homogeniser and filler at the time. The primary judge made an unchallenged finding that the parties knew at the time that the homogeniser and filler were still owned by the vendor, and that they precisely met the specifications for the corresponding components to be supplied under the new contract: Sanmik Food Pvt Ltd v Alfa Laval Australia Pty Ltd [2024] NSWSC 698 at [42].

[112] The common ground that title had not passed at the time of the settlement is undoubtedly correct. Unless the Initial Contract operated to effect a transfer of title from the vendor to the purchaser, nothing else in the parties’ dealings prior to entry into the Settlement Deed could have had that effect. The Initial Contract contained the following retention of title clause:

Reservation of Ownership / Insurance

Ownership of the equipment/module to be delivered shall pass to the Purchaser only upon receipt of the full purchase price by the Seller. Moreover, until that date, the Purchaser will keep the equipment/module insured against all risks, in particular fire for an amount at least corresponding to the agreed purchase price.

[113] Because the full amount of the purchase price was never paid, the effect of this clause was that title did not pass under the Initial Contract prior to its termination.

[114] That it was uncontroversial that the vendor had not parted with title to the homogeniser and filler at the time of the settlement is central to each of the issues raised in the appeal.

Ground 1(a): clause 3.2(a)

[115] Ground 1(a) is to the effect that by reason of cl 3.2(a), the vendor “no longer had any claim to title to the Homogeniser and Filler”. As this ground was argued, it extended not only to the question whether the vendor retained title in the sense of property in the homogeniser and filler, but also to the question whether the vendor was entitled to assert against the purchaser any claim of right that had flowed from its title, including the right of a bailor to have goods re-delivered to it.

[116] “A bailment comes into existence upon a delivery of goods of one person, the bailor, into the possession of another person, the bailee, upon a promise, express or implied, that they will be re-delivered to the bailor or dealt with in a stipulated way”: Hobbs v Petersham Transport Co Pty Ltd (1971) 124 CLR 220 at 238; [1971] HCA 26 per Windeyer J.

[117] The homogeniser and filler were originally delivered to the purchaser in the following circumstances: (1) the vendor gave the purchaser the right of exclusive possession; (2) the purchaser took possession voluntarily; (3) either as a matter of the proper construction of the Initial Contract (including the retention of title clause) or by necessary implication, the purchaser assumed a responsibility to keep the homogeniser and filler safe pending payment of the full purchase price; and (4), by implication in all the circumstances, the purchaser undertook an obligation to re-deliver the homogeniser and filler to the vendor in the event that the purchaser failed to pay the full purchase price. It follows (and it does not appear to be in dispute) that upon delivery the purchaser held the homogeniser and filler as bailee.

[118] What the purchaser disputes is the legal character of the bailment, and how long it continued. The purchaser sought to subsume the bailment wholly within the Initial Contract, such that when the contract was terminated, so too was the bailment. Thus, Senior Counsel for the purchaser submitted at the hearing of the appeal: “The way it was pleaded … was that it was a bailment under the contract.” (Tcpt, 9 December 2024, p 45/32; emphasis supplied.) This was a reference to [14]–[21] of the vendor’s Further Amended Commercial List Cross-Claim Statement. It is true that the vendor alleged at [14] that it had delivered the homogeniser and filler to the purchaser “pursuant to” the Initial Contract. But the vendor also alleged that ownership of the homogeniser and filler had remained with the vendor, that the vendor had terminated the Initial Contract by letter dated 24 August 2022, and, at [21], that following the termination of the Initial Contract (and also following entry into the Settlement Documents), either the bailment remained in effect or a new bailment came into effect. That was, clearly enough, a pleading that the bailment existed independently of the Initial Contract. That allegation was well-founded.

[119] It is true that, prior to its termination, the Initial Contract had in some respects regulated the terms of the bailment. That explains, for example, the vendor’s allegation at [20] that “[b]y reason of” the matters earlier alleged, including the delivery pursuant to the Initial Contract, the purchaser was “to hold the Homogenizer and Filler as bailee for the [vendor] until the full purchase price under the Contract was paid.” But the bailment relation that came into existence upon delivery of the homogeniser and filler to the purchaser was itself conceptually and legally distinct from the Initial Contract, and the vendor’s allegation at [20] was not inconsistent with that proposition. From the outset, the bailment arose under the general law, as an incident of the separation of ownership and possession and the circumstances in which that occurred. The fact that the delivery of the homogeniser and filler into the purchaser’s possession occurred pursuant to the Initial Contract does not undermine the distinct legal character of the bailment; it was simply one of the circumstances which gave rise to the bailment.

[120] That was the position immediately prior to termination of the Initial Contract.

[121] By cl 3.2(a) of the Settlement Deed, “On and from the execution of this deed,” the vendor agreed that the Initial Contract “has been terminated and that the parties have no further obligations in respect of the Contract”. The parties had been litigating the vendor’s assertion that it had terminated the Initial Contract for the purchaser’s breach and/or repudiation. This clause resolved the existing dispute about the validity of the termination. For present purposes it does not matter whether the date of the agreed termination is taken to be the date of the vendor’s letter of termination (24 August 2022) or the date of the Settlement Deed (22 March 2023). The important point is that the clause should be read as recording the parties’ agreement about two matters. First, that the termination had already happened (“has been terminated”). Secondly, that the ordinary legal consequence of such a termination followed, namely, that the parties were discharged from further performance of the Initial Contract. Although the whole of cl 3 is headed “Release”, cl 3.2(a) thus operated very differently from the express release in cl 3.2(b).

[122] As to the first of the matters agreed in cl 3.2(a), once the Initial Contract was terminated, it no longer regulated the bailment. But the purchaser’s submission that the termination of the Initial Contract also necessarily determined the bailment should be rejected. As noted above, even prior to termination of the contract, the bailment relation between the vendor and purchaser was distinct from the contract. It would be a mistake to treat the purchaser’s obligations under the bailment here as though they were in effect mere implied terms of the Initial Contract which came to an end with the contract. Nor was the subsistence of any contract a necessary element of the bailment relation; the relationship of bailor and bailee of a chattel can arise and exist independently of contract: Hobbs at 239 per Windeyer J.

[123] Although the termination of the Initial Contract meant the parties were discharged from future performance of it, that did not undo what had already occurred in fact (whether pursuant to the contract or otherwise); nor did the termination undo the legal effect of what had occurred. In particular, the purchaser’s responsibility to re-deliver the homogeniser and filler to the vendor in the event that the purchaser failed to pay the full purchase price was not discharged by the termination of the Initial Contract. To the contrary, termination of that contract was likely to be a circumstance in which the purchaser would have failed to pay the full purchase price and therefore be obliged to re-deliver the goods.

[124] As to the second of the matters agreed in cl 3.2(a), the vendor’s agreement that “the parties ha[d] no further obligations in respect of the Contract” does not assist the purchaser. Clause 3.2(a) said nothing about the vendor’s ownership of the goods; nor about the distinct bailment relation between the parties. The vendor’s title to the homogeniser and filler existed independently of the Initial Contract. The vendor’s title was not (a) an obligation (b) of the purchaser (c) in respect of that contract. So too, for the reasons given above, the bailment, and the purchaser’s obligations under it, were distinct from the contract. The vendor’s right to have the homogeniser and filler re-delivered to it pursuant to the bailment was not an “obligation” of the purchaser in respect of the contract.

[125] The position upon termination of the Initial Contract was thus as follows: title to the homogeniser and filler remained with the vendor; the purchaser remained in physical possession of those goods; the parties had no further obligations to perform under the Initial Contract; but the purchaser continued to hold the homogeniser and filler as bailee. The vendor thus continued to enjoy its right as bailor to have the homogeniser and filler re-delivered to it.

[126] Ground 1(a) fails.

Ground 1(b): clause 3.2(b)

[127] The fact that at the time of the settlement there was no dispute between the parties either as to the vendor’s title to the homogeniser and filler, or as to the vendor’s right to have those goods re-delivered pursuant to the bailment, is important context for the construction of the release in cl 3.2(b). While it is true that cl 1.3 of the Heads of Agreement annexed to the draft deed of settlement had been deleted in the course of negotiations between the parties, that draft clause had been directed to a different subject matter: “The Parties agree that part of the plant for Plant 1 has already been delivered being 1 filler and 1 homogeniser.” The fact that the purchaser may have been unwilling to include in the Settlement Documents a provision acknowledging in terms that the new contract had already been performed in part is a long way from constituting a dispute, still less a dispute about the vendor’s title or right to have those goods re-delivered.

[128] Clause 3.2(b) is expressed as a release of “all Claims and actions arising from or in connection with the Settled Matters”. The clause thus invokes two defined terms: “Claim” and “Settled Matters”.

[129] “Claim” is defined inclusively as “any claim, action or liability of any kind (including one which is prospective or contingent and one the amount of which is not ascertained) and costs …” The vendor submitted that the word “claim” could mean either a claim in the sense of a demand, or a claim in the sense of a right. In the context of a deed of settlement the first of those two meanings is the more natural reading. As will be seen, that construction is strengthened once the definition is read in the context of the substantive clause, including the term “Settled Matters”.

[130] The term “Settled Matters” is effectively defined in recital H. This records that “the parties have agreed to settle all claims and disputes between them which were the subject of, or in any way related to: …” various subjects, which include at (c) the Initial Contract and at (d) “the supply of the First UHT Plant and the Second UHT Plant”. The “claims and disputes” about those subjects are then described as the “Settled Matters”. It is important to bear in mind that the Settled Matters were not the subjects listed in recital H; the Settled Matters were “all claims and disputes between [the parties]” which related to those subjects.

[131] Just as the adjective “all” is most naturally read as describing both “claims and disputes”, so too are the words “between them” most naturally read as qualifying both “claims and disputes”, as part of what should be understood as a composite phrase. That these were claims or disputes “between” the parties suggests that a “claim” means an asserted demand, rather than a right. The choice of the verb “settle” in recital H also suggests that “claim” means an asserted demand. So too does the use of the past tense (“which were the subject of, or in any way related to”). The Settled Matters should thus be read as confined to demands that had actually been asserted prior to the time of the settlement.

[132] To construe “claim” in the definition of “Settled Matters” as meaning a demand that had actually been asserted is consistent with the longstanding approach to construing releases at law. Thus, as Leeming JA (Bell CJ agreeing) said in Reid v Commonwealth Bank of Australia (2022) 109 NSWLR 149; [2022] NSWCA 134 at [33], at law:

releases are to be construed narrowly, with general words confined to those things which were ‘specially in the contemplation of the parties at the time when the release was given’: Directors &c of the London and South Western Railway Company v Blackmore (1870) LR 4 at 623. Lord Westbury added (at 623–64) that ‘a dispute that had not emerged, or a question which had not at all arisen, cannot be considered as bound and concluded by the anticipatory words of a general release.’

[133] Defined terms must ultimately be interpreted in the context of the substantive provision in which they are used. Given the inclusive definition of “Claim” and the syntactically complex way in which the “Settled Matters” are defined, it is not straightforward to read the two defined terms into cl 3.2(b). Upon doing so, the substantive provision is to the effect that the vendor “releases and forever discharges [the purchaser] from all Claims [ie, any claim (in the sense of a demand), action or liability] and actions arising from or in connection with the Settled Matters [ie, arising from or in connection with any claims (in the sense of demands that had been asserted) and disputes between the parties which were the subject of, or in any way related to, the subjects listed in recital H]”. In light of recital G (which refers to the commencement of the proceedings in the Supreme Court of New South Wales) and recital H, cl 3.2(b) should be read as releasing only matters which had actually been in dispute prior to the settlement.

[134] The purchaser’s basic difficulty is that neither the vendor’s title to the homogeniser and filler, nor the vendor’s right to re-delivery of those goods pursuant to the bailment, meets the description of a claim (in the sense of a demand), action or liability arising from or in connection with the Settled Matters as defined. That is so for several reasons.

[135] First, as noted above, the Settled Matters were not the subjects listed in recital H (such as “the supply of the First UHT Plant and the Second UHT Plant”); the Settled Matters were the extant “claims and disputes between” the parties which related to those subjects. At the time of the settlement, there had been no claim (in the sense of a demand) or dispute between the parties about either the vendor’s title to the homogeniser or filler, or the vendor’s right to re-delivery of those goods under the bailment. Nor did the vendor’s title to the homogeniser and filler, or its right to have them re-delivered under the bailment, “arise from or in connection with” any such extant demand or dispute at the time of settlement. The vendor’s title, and its right to re-delivery, arose independently of any such claims or demands. If the vendor’s title to the homogeniser and filler is to be seen as “arising from or in connection with” the Settled Matters, so too must the vendor’s title to any other equipment it purchased for the purposes of the Initial Contract. That would be a surprising outcome.

[136] Secondly, what cl 3.2(b) releases are “Claims”. As defined, these are demands rather than rights. But the vendor’s title to its goods is not a mere demand against the purchaser; it is a right of property good against the whole world.

[137] Thirdly, even if, contrary to the above, the word “claim” should be read here as extending to a mere right as opposed to an asserted demand, and even if the vendor’s hitherto undisputed title to the homogeniser and filler is thus to be understood as a “claim”, it makes little sense to say the vendor “releases and forever discharges” the purchaser from the vendor’s title to those goods. If those words were to be construed as effecting a transfer of title from the vendor to the purchaser, this was strange language for that purpose, particularly when such a transfer was not otherwise contemplated by the parties. But it would be stranger still if the effect of cl 3.2(b) was that the vendor retained title to (ie, ownership of) the homogeniser and filler, but surrendered its (also hitherto undisputed) right to re-delivery of those goods under the bailment.

[138] As a matter of construction of the Settlement Deed at law, there was no transfer of title to the homogeniser or filler, no “release” of the vendor’s claim to title to those goods, and no release of the vendor’s right as bailor to the return of the goods. Ground 1(b) fails.

[139] There is accordingly no occasion to consider the scope of any equitable doctrine.

Ground 2: did the vendor agree not to use the homogeniser and filler in performance of the new contract?

[140] Under the settlement the vendor assumed a new and distinct obligation to supply two plants. That obligation is rooted in clause 2.1(a) of the Settlement Deed, which is a promise to enter into the Commercial Terms and Supply Terms “for a new supply that is independent of the previous Contract in the form annexed to this deed”.

[141] The vendor was required to perform its obligation by supplying plants which met the specifications in the Supply Terms. In respect of the first plant, the obligation was not simply to deliver the homogeniser and filler; it was to supply a complete plant. That involved not only the delivery of component parts but the commissioning of the complete plant, of which the homogeniser and filler were important components. Subject to the terms of the parties’ agreement, the vendor was entitled to discharge its obligation to perform the new contract by using any equipment available to it. Since title to the homogeniser and filler remained with the vendor, and since the vendor had not released its right to re-delivery of the goods under the bailment, subject to the terms of the parties’ agreement, that equipment would include the homogeniser and filler already on site in Sri Lanka.

[142] The Settlement Documents must be construed against that background. It would be somewhat surprising if the vendor retained title to the homogeniser and filler, and had the right under the bailment to re-take possession of them, and those components perfectly matched the specifications required under the new contract, but the parties nevertheless agreed that the vendor was prohibited from using the homogeniser and filler to perform its contractual obligation to supply a plant. The parties could of course agree to that outcome if they so chose; but there was no express term to that effect. There were provisions in the Settlement Documents, identified by Adamson JA and Griffiths AJA, which would be consistent with either position. Viewed as a whole, they are insufficient to found the implication the purchaser requires. For the reasons given by Griffiths AJA, I am not persuaded that Ground 2 is made out.

[143] The appeal should be dismissed with costs.

Griffiths AJA.

[144] I have had the considerable advantage of reviewing Adamson JA’s reasons for judgment in draft. The issues of construction raised by the appeal are strongly contestable. Their resolution is not straightforward. For the following reasons, however, I respectfully disagree with the orders proposed by her Honour. I consider that the appeal should be dismissed, with costs.

[145] There is no need for me to repeat the terms of the relevant documentation, describe the relevant events or summarise the legal principles and the parties’ submissions. With one exception, the material matters are comprehensively set out by Adamson JA (I will also gratefully adopt her Honour’s abbreviations).

[146] In my view, that exception relates to the significance as an aid to construction (once it is apparent that the relevant clauses in the Settlement Documents do not have a plain meaning) of the Customs Invoice dated 17 July 2019. This Customs declaration was made by the vendor and copied to the purchaser. It describes the proposed entry into Sri Lanka of the filler and the homogenizer, being the two items at the heart of the dispute. I consider it significant that the nominated total value of the two items was the substantial sum of AUD$588,000 (comprised of amounts of $428,500 and $159,500 for the filler and homogenizer respectively). Thus the declared total value was approximately $200,000 more than the money paid by the purchaser under the terms of the Initial Contract (being $387,600).

[147] The substantial value of the two items, as declared to Sri Lankan Customs, was known to both parties. Indeed, it is one of the seven matters which the purchaser identified below in a document dated 17 May 2024 and headed “Critical surrounding circumstances known to both parties”. Moreover, in closing address below, the purchaser’s then senior counsel acknowledged that both parties knew of the declared value of $588,000; and, in oral address on the appeal, the purchaser’s replacement senior counsel described the homogenizer, filler and tank as “the three main components of the plant”.

[148] The invoice forms part of the surrounding circumstances relevant to the issues of construction once it becomes clear that the contractual provisions do not have a plain meaning. In particular, I consider that it lends support to a construction which favours the view that the releases did not apply to the vendor’s undisputed title to the two items.

[149] Objectively viewed, it is unlikely that the parties intended that the two items would simply become “White Elephants” and not be employed as part of the equipment to be supplied under the new Supply Contract. That is all the more so in circumstances where the declared value of the items was not only considerable; they were also brand new (having apparently been stored by the purchaser in its warehouse from the time of their delivery until some time after the Settlement Documents were executed). Moreover, and notably:

(a) the two items were customised and met the specifications for those particular components to be supplied under the new Supply Contract (see at [3] of the vendor’s document below headed “Surrounding circumstances”);

(b) it was common ground that Sanmik considered that the two components were unable to be used without the remainder of the Plant (see [6] of the “Critical surrounding circumstances known to both parties” document); and

(c) when the Settlement Documents were executed, there was no dispute or contest that the vendor retained title to the filler and homogenizer, having regard to the terms of the Initial Contract and the purchaser’s failure at that time to pay the full purchase price.

[150] These surrounding circumstances all point to the likelihood, objectively viewed, of the parties agreeing in the Settlement Documents to the two items being utilised in the new supply contract rather than effectively being rendered redundant and “replaced” by two new identical customised items of equipment.

[151] The objective logic of these matters leans against a construction of the documentation which would result in the vendor having to transport and ship two identical items for the purposes of the new supply contract, leaving the other two items idle unless the vendor was able to sell them for spare parts (presumably at a discount and possibly having to have them refabricated or redesigned given that they were customised) or incur what might reasonably be expected to be significant transport costs in shipping them elsewhere.

[152] I consider that these particular surrounding circumstances, which were known to both parties, are relevant aids to the construction of the Settlement Documents, having regard to what was said by French CJ, Nettle and Gordon JJ in Mount Bruce Mining Pty Ltd v Wright Prospecting Pty Ltd (2015) 256 CLR 104; [2015] HCA 37 at [46] –[49] (footnotes omitted):

[46] The rights and liabilities of parties under a provision of a contract are determined objectively, by reference to its text, context (the entire text of the contract as well as any contract, document or statutory provision referred to in the text of the contract) and purpose.

[47] In determining the meaning of the terms of a commercial contract, it is necessary to ask what a reasonable businessperson would have understood those terms to mean. That inquiry will require consideration of the language used by the parties in the contract, the circumstances addressed by the contract and the commercial purpose or objects to be secured by the contract.

[48] Ordinarily, this process of construction is possible by reference to the contract alone. Indeed, if an expression in a contract is unambiguous or susceptible of only one meaning, evidence of surrounding circumstances (events, circumstances and things external to the contract) cannot be adduced to contradict its plain meaning.

[49] However, sometimes, recourse to events, circumstances and things external to the contract is necessary. It may be necessary in identifying the commercial purpose or objects of the contract where that task is facilitated by an understanding “of the genesis of the transaction, the background, the context [and] the market in which the parties are operating”. It may be necessary in determining the proper construction where there is a constructional choice. The question whether events, circumstances and things external to the contract may be resorted to, in order to identify the existence of a constructional choice, does not arise in these appeals.

[153] As is evident from Adamson JA’s detailed analysis, the relevant provisions of the Settlement Documents are not unambiguous or susceptible of only one meaning. If they were, there would be no warrant to have recourse to any relevant surrounding circumstances.

[154] And, as stated by P Herzfeld and T Prince in Interpretation (3rd ed, 2024, Lawbook Co) at [19.70]: