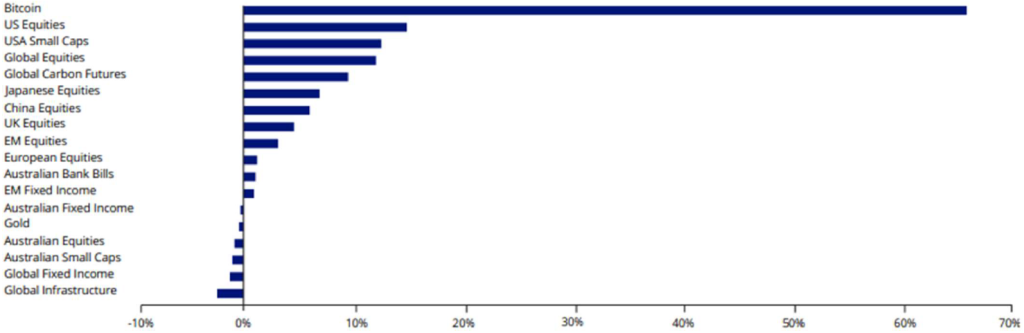

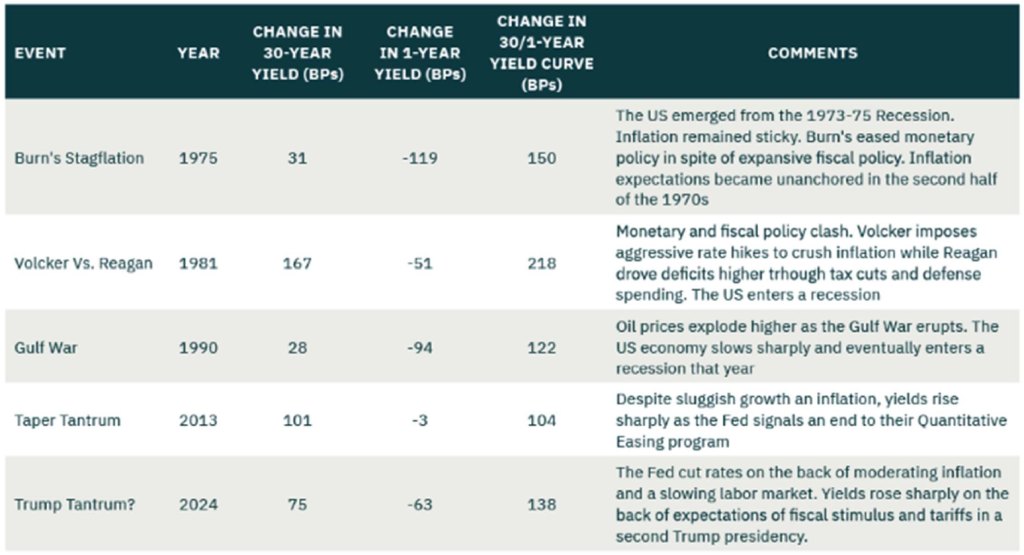

The election of Donald Trump late in 2024 meant the beginning of the era of Trump 2.0. Post Trump’s election, risk assets have rallied strongly, principally on a belief that the new Government would aggressively pursue many of his election promises including increasing tariffs, restricting immigration, cutting regulation and extending tax cuts.

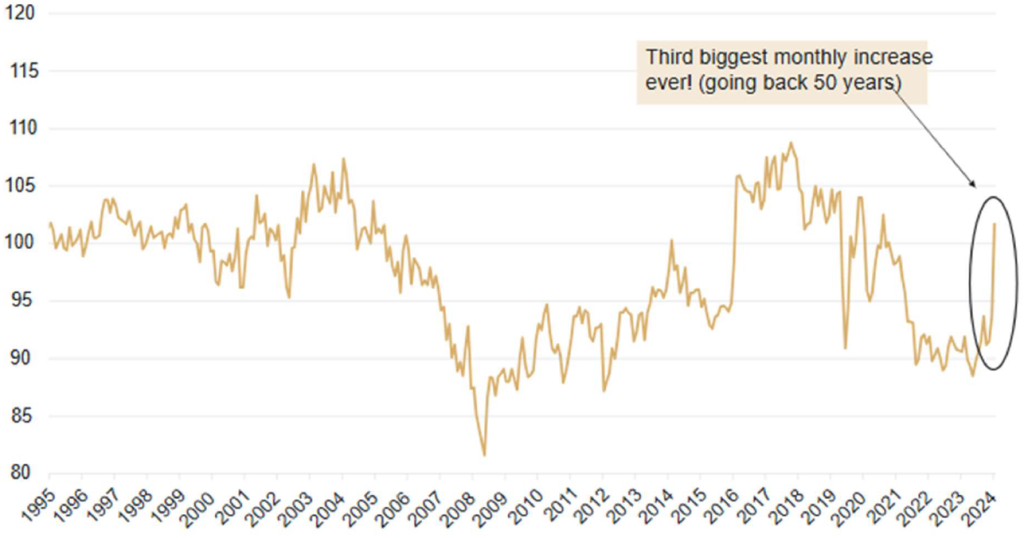

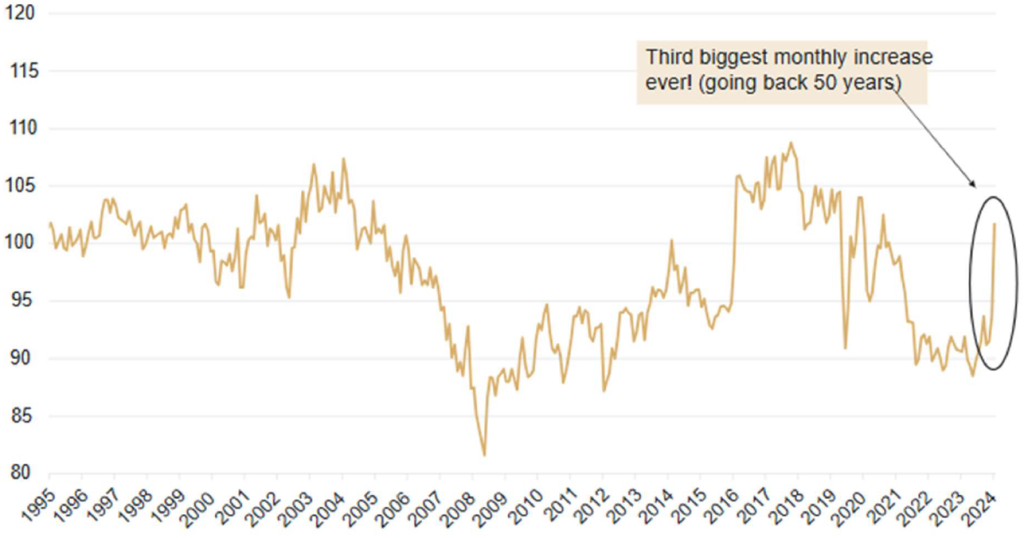

Both optimism (small business hirings) and asset values responded positively (see Figures 1 and 2). However, some of this enthusiasm has begun to fade in recent weeks with asset markets experiencing more volatility.

Ultimately, the sequencing and execution of Trumps’ various policy decisions will create both risks and opportunities across global equity and bond markets. As we await this ‘golden era’, what could possibly go wrong?

Figure 1- Asset class returns for Dec ¼ 2024 (Source: VanEck)

Figure 2 – US small businesses Optimism Survey (Source: Ophir Asset Management)

Valuations – Where to From Here?

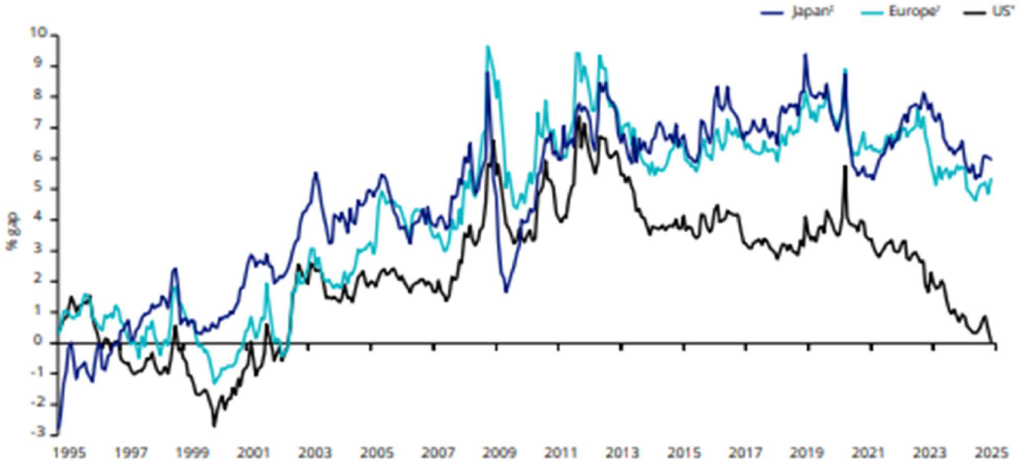

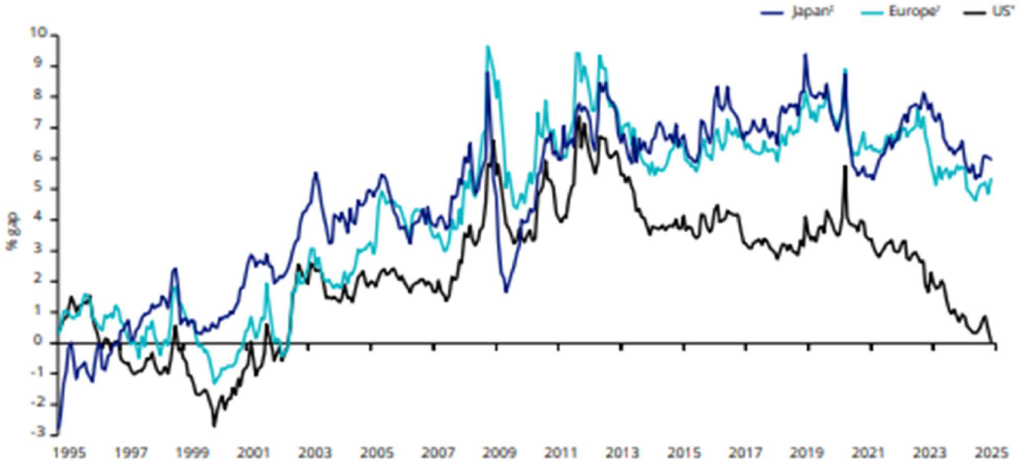

Equity valuations here and in the US are off recent highs, whilst much of this is attributed to Trump 2.0 other factors such as, exuberance over the impact of generative AI, reductions in the US Federal Reserve Bank’s (Fed) funds rate (short term interest rate) due to moderating inflation and wages growth and extension of the limit on US Federal debt have all played a part. US equities appear fully priced. The yield premium between equities and risk-free treasuries is near zero. By contrast, Japanese and European equities appear to still offer value (see Figure 3).

Figure 3 – Few equity markets (as measured by risk premiums) look cheap (Source: VanEck)

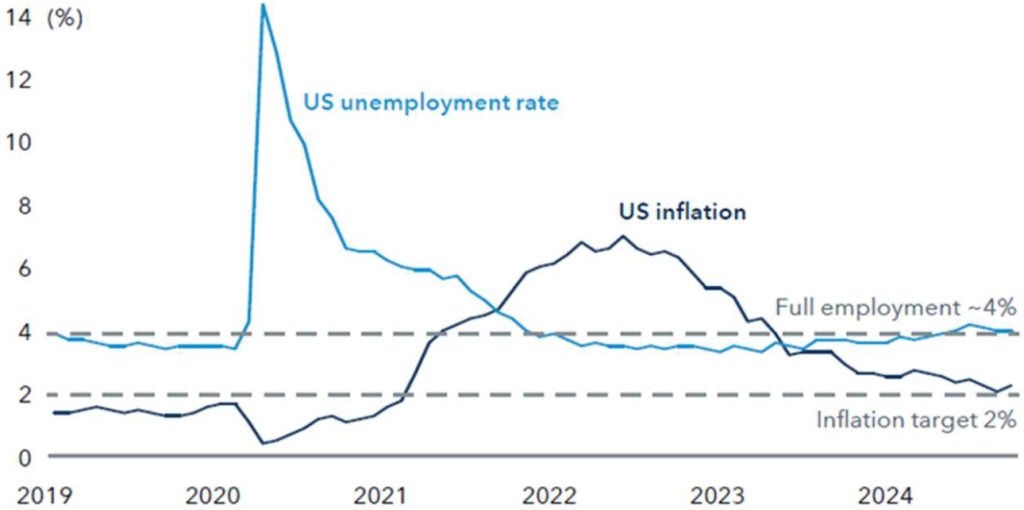

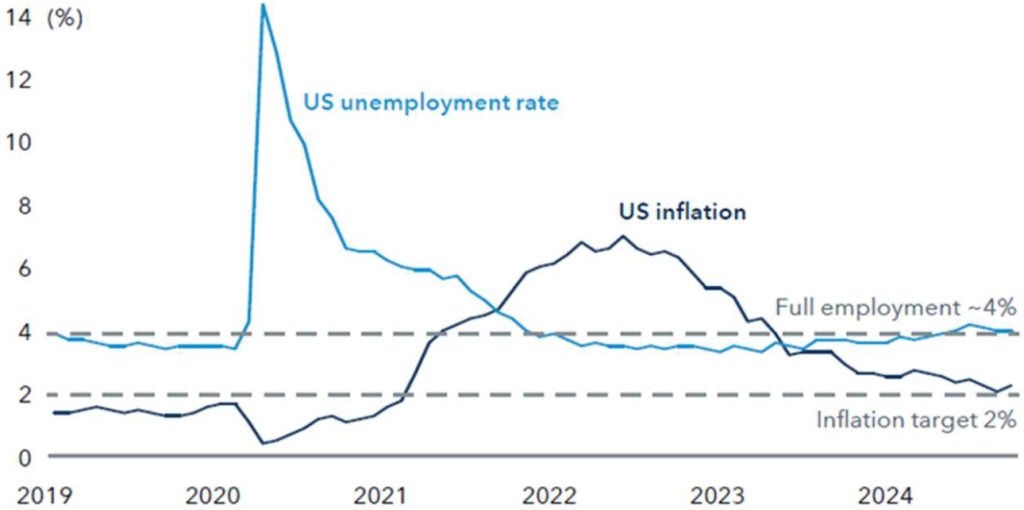

Short Term Interest Rates and InflationThe US is essentially experiencing a ‘no landing’ scenario, albeit with inflation approaching, but still above Federal Reserve (Fed) target of 2% (see Figure 4).

Figure 4 – US employment and inflation have largely normalised (Source: Capital Group)

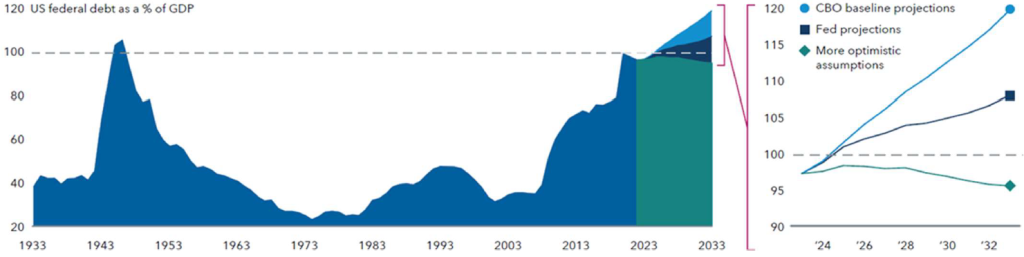

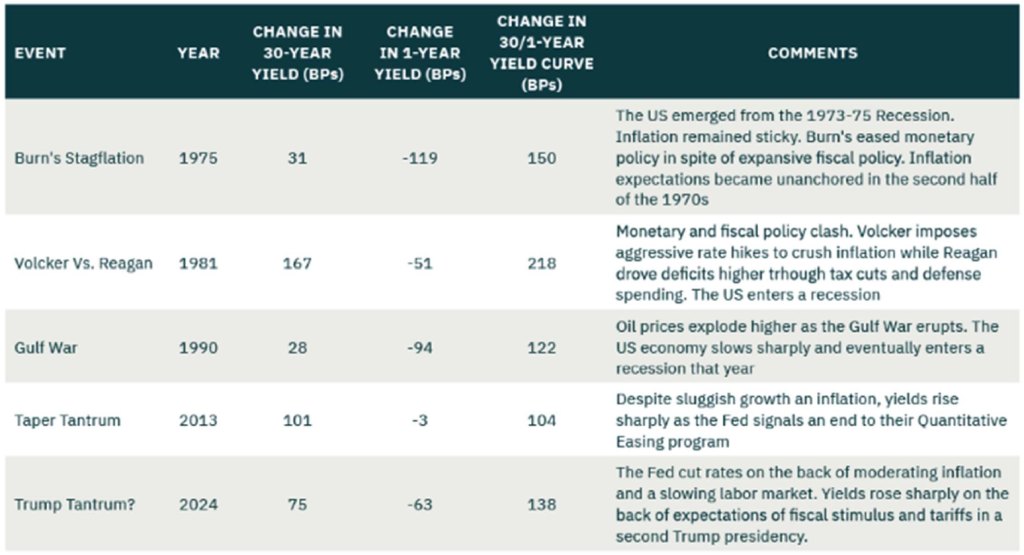

Markets are convinced that the Fed will not deliver more than 49 basis points of cuts in 2025. Whilst this had been largely expected, paradoxically long term (30-year bond) yields rose by 0.75 % in 2024. Further,1-year bond yields fell by 0.63% resulting in a rare ‘bear steepening’ of the 30/1-year curve (see Figure 5). When this has occurred during that past 60 years, there has been a severe economic or political shock. At a time when the Fed intended to improve borrowing conditions by lowering policy rates, the part of the curve which matters most to the economy (unlike Australia most US borrowing is generally fixed for 10 to 30 years), is now higher!

Figure 5 – Previous Bear Steepening Periods (Source: BCA Research)

Tariffs“To me the most beautiful word in the dictionary is tariff; trade wars are good, and easy to win” (President Trump). However, this depends on who is paying them. During the Trump 1.0 trade war (2016 to 2019) tariffs were used as temporary measures to force various trade concessions from other countries. Several studies demonstrated that during that time, US businesses overwhelmingly bore the brunt of tariff costs, resulting in lower profit margins, lower wages and employment, and higher prices to consumers (VanEck 2024).

UBS believe that a 10% universal tariff would be far more damaging to global growth and inflation. Factoring in potential retaliation, delays and loopholes make estimates difficult to predict, predicted ‘real global growth’ may decline by ~0.5 to 1% in 2025 and to expand further in 2026. US inflation could rise 1.6%, which suggests less monetary easing globally and a firmer dollar. UBS forecast that the tariffs could reduce Asian economic growth by ~0.3% to 0.5%. Trump’s earlier threat of 25% tariffs on Mexico and Canada saw both countries shift to action on controlling the movement of fentanyl and unauthorised immigration.

At time of writing, Trump announced the US would impose “reciprocal tariffs” (tariffs on trading partners) in line with the tariffs they imposed on US imports including 25% tariffs on all steel and aluminium imports causing some concern for Australia. The concern is that if they are permanent, they will likely lose their negotiating value and risk a sustained increase in US inflation and retaliation from other countries (BetaShares).

Morgans Chief Economist, Michael Knox believes Trump intends to use the introduction of a 10% revenue tariff to generate between $US350 and $US400 billion, offsetting the cost of the corporate tax cuts proposed in an omnibus bill able to be passed with a simple majority vote in the Senate. (Morgans 2025) Refer to the following link to Michael’s article (https://morgans.com.au/news/trumps-tariffs-drug-war-not-trade-war).

Labour Market Developments

The Trump administration has commenced implementing stringent immigration policies by restricting the number of people entering the US and deporting undocumented immigrants to several countries. However, current numbers have been small compared to his goal of deporting up to one million immigrants a year. Currently, there are 7million unemployed in the US (4.2% of the workforce). Removing 4 million people, would bring the unemployment rate down to near 2%, possibly triggering a boom in wages and put downward pressure on corporate profit margins. This combination of heightened costs and reduced spending would likely create headwinds for equity markets.

What Could Possibly Go Wrong…?

There is growing scepticism that Trump 2.0 will result in a dramatic increase the Federal deficit. Recent theatre around the end-of-year extension to government funding suggests that continuing and/or enlarging tax cuts in 2025 might be more difficult than investors expect.

Wharton Business School estimates that Trump’s fiscal proposals will extend the budget deficit by a further US$600 billion a year over the next decade, or around 2% of US GDP p.a. With a budget deficit already running near 7% of GDP, in an economy not far from full employment, this is unsustainable (BCA Research). Results might see an overheating economy, forcing the Fed to increase rates, putting upward pressure on the US dollar and thus reducing competitiveness. Likely making it difficult to bring the much-promised manufacturing jobs back to the US.

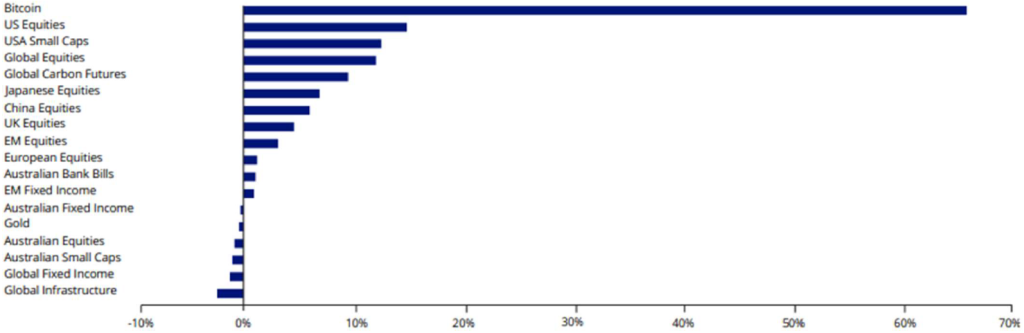

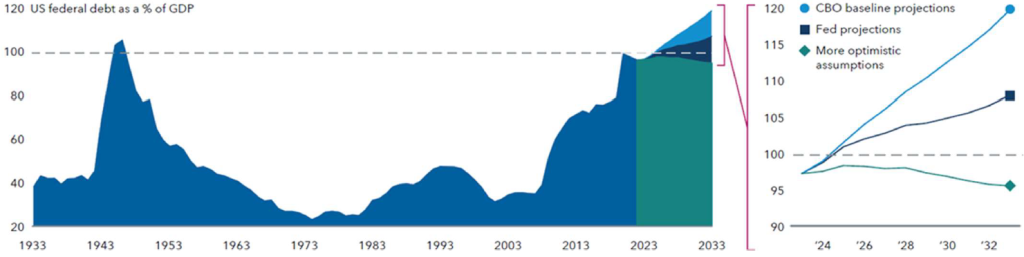

The US debt to GDP ratio is close to 100%. This means the ratio will grow whenever nominal interest rates exceed nominal growth. The Fed Open Market Committee’s long-range projections are for real GDP growth of ~2% and inflation ~2%. That is, whenever the interest rate on government debt rises above 4% the debt ratio will increase. Add future fiscal deficits every year and the debt to GDP ratio goes parabolic (even without the extra policy impost). The Congressional Budget Office projects debt to GDP of 166% within 30 years (see Figure 6). At that level it may cease to be a US problem alone, but rather could lead to global instability. On the other hand, optimists point to the newly created Department of Government Efficiency (DOGE), led by Elon Musk as holding the key to reining in the deficit by cutting costs and reducing regulation. Already Trump has signed Executive Orders demanding all Federal Government employers return to the office and other more contentious initiatives such as decimating USAID.

Dramatically increasing the US deficit would increase inflation at a time when high prices are the number one concern for Americans (and Australians). Even if the tax cuts are extended, the cost of servicing US government debt will skyrocket to unprecedent levels. While some investors argue that President Trump does not need to abide by these constraints, since this will be his last term in office, this is clearly not the case for House Republicans who will have to face a (midterm) election in less than two years. Increasing inflation or sinking the US economy into a fiscal crisis will likely lead to defeat for House Republicans in the midterms.

Figure 6 – US debt at near 100% of GDP. Is this nearing a Tipping Point? (Source: Capital Partners)

Summary

As we came to learn during the first Trump administration, rhetoric and reality can often be at odds. However, (except for COVID) it was a very positive period for asset prices. This time around, some of the positivity is already priced in. Trump 2.0 has a stronger mandate and a renewed determination to make changes that should be beneficial for the US (and hopefully its allies like Australia). The sequencing and execution of critical policy decisions will likely bring about movements in interest rates, currency valuations, and terms of trade.

The coming Australian Federal election is also set to influence our investment markets demanding investor attention on cost of living and energy policy as defining election issues for Australia. The sequencing and execution of such issues will be critical, and markets could go in either direction. Investors should remain conscious of these changes particularly movements in bond markets as the ‘golden era?’ dawns.

We have a range of strategies and investment products to better position for some of these changes. If these are of interest, please contact us.

Andrew FlemingBBus MBA GradDip App Fin & Inv MSIAAInvestment Adviser | StockbrokerAuthorised Rep: 000466078Direct: 07 3152 0604Email: andrew.fleming@morgans.com.au

Michael BorjessonBBus (Econ) FFin CFP®Financial Adviser | Authorised Rep: 000466077Direct: 07 3152 0606Email: michael.borjesson@morgans.com.au

Disclaimer: The information contained in this report is provided to you by Morgans Financial Limited as general advice only and is made without consideration of an individual’s relevant personal circumstances. Morgans Financial Limited ABN 49 010 669 726, its related bodies corporate, directors and officers, employees, authorised representatives, and agents (“Morgans”) do not accept any liability for any loss or damage arising from or in connection with any action taken or not taken on the basis of information contained in this report, or for any errors or omissions contained within. It is recommended that any persons who wish to act upon this report consult with their Morgans investment adviser before doing so.

Sources:Bassanese, D. (10 Feb 2025). Bassanese Bites – Reciprocal Tariffs. Betashares

Correa, J et al. (6 Jan 2025). Monthly TAA Report: WARNING. Animal Spirits On Premises. Enter at Own Risk. BCA Research

Knox, M. (10 Feb 2025). Economic Strategy – Trump, Taxes and Tariffs. Morgans Financial

Romo, M et al. (Dec 2024 Outlook 2025). Long-term perspective on markets and economics. Capital Group

Mitchell, A and Ng, S. (16 Jan 25). December Letter to Investors. 16 Jan 25. Ophir Asset Management

NA. (Dec 2024). The Year Ahead, The Roaring 20s – The next stage. UBS

NA. (Jan 2025). VanEck ViewPoint – Priced to Perfection. VanEck

Figure 1- Asset class returns for Dec ¼ 2024 (Source: VanEck)

Figure 1- Asset class returns for Dec ¼ 2024 (Source: VanEck)

Figure 2 – US small businesses Optimism Survey (Source: Ophir Asset Management)

Figure 2 – US small businesses Optimism Survey (Source: Ophir Asset Management)

Figure 3 – Few equity markets (as measured by risk premiums) look cheap (Source: VanEck)

Figure 3 – Few equity markets (as measured by risk premiums) look cheap (Source: VanEck)

Figure 4 – US employment and inflation have largely normalised (Source: Capital Group)

Figure 4 – US employment and inflation have largely normalised (Source: Capital Group)

Figure 5 – Previous Bear Steepening Periods (Source: BCA Research)

Figure 5 – Previous Bear Steepening Periods (Source: BCA Research)

Figure 6 – US debt at near 100% of GDP. Is this nearing a Tipping Point? (Source: Capital Partners)

Figure 6 – US debt at near 100% of GDP. Is this nearing a Tipping Point? (Source: Capital Partners)