By William Wild

Introduction

It is notorious that few active fund managers can beat a market benchmark consistently enough to distinguish their performance from mere chance, and even then it is effectively impossible for a potential client to identify those rare outperformers ex ante.iii

It is not necessary to accept the doubtful academic orthodoxy, that financial markets are efficient aggregators of previously unknown information, in order to accept that beating the market is extremely difficult. It will be so even if markets are inefficient, in the sense that prices do not correlate to the long-term value of the financial assets being traded. When the prices of long-term assets are set in liquid markets whose dominating concerns are only with what the market prices of those assets will be in the next minute, hour, day or month, then in John Maynard Keynes’ words;

We have reached the third degree where we devote our intelligences to anticipating what the average opinion expects the average opinion to be. … to guess better than the crowd how the crowd will behave …iv

And yet the active fund management industry not only survives but continues to generate significant revenue – for itself. A number of explanations might be posited for the apparently irrational willingness of clients to pay active fund managers: having an active fund manager is a positional good, signalling the client’s status; clients value the interaction with their fund managers, and clients value the security, even if it is false, of having the benefit of professional fund management.

These explanations are almost certainly true as far as they go, but cannot in themselves explain the scale of the active fund management industry. In particular, they cannot explain why an industry that, on average generates no investment outperformance relative to market benchmarks, then takes such a significant level of management and performance fee that its clients end up, on average, so significantly worse off than if they had invested passively in a benchmark index.v

This is of more than academic significance to us as counsel.

The judgment in the significant English case of SPL Private Finance v Arch Financial Productsvi (the “Arch Cru” case) confirmed that fund managers, even if exercising discretionary powers under contract, nevertheless owe fiduciary duties not to put their own interests ahead of their clients’. And the law of fiduciaries should be sufficiently flexible to provide an appropriate remedy for any clear breach of that duty. Yet a search of the case law shows that few private clients have pursued their active fund managers in the civil courts for losses realized under their management.

I readily concede that a client who engages an active fund manager is usually made aware — at least by some formulaic disclaimer – of the risk that active management can generate underperformance as well as outperformance. So the mere fact that a client has suffered loss relative to a market benchmark is unlikely to sustain an action against their manager. In my view, however, the standard disclaimer has been far more successful in deterring actions by clients against their managers than it should perhaps have been. In this short paper I explain why.

Incentives

The reality is that while clients might be intellectually aware that active fund managers can underperform, few enter such an arrangement with any realistic expectation that their active fund manager will do so. Obviously a manager pitching for a new client encourages this perception as far as possible without making any objective statement or guarantee of performance that could found a subsequent claim in misrepresentation.

So when such underperformance does eventually happen, few clients are likely to accept it as the inevitable consequence of their choice of active fund management. And a disappointed client is likely to exercise its ultimate power to terminate its manager. The long-term success of an active fund manager might thus be seen as a function of its ability to retain clients for as long as possible, and to generate the greatest level of fee in that time, in the face of underperformance. The long-term success of the industry as a whole suggests that beating clients is much easier than beating the market.

Some of the strategies that might be adopted are relatively unobjectionable, or at least, un-actionable. For example, a manager, while purporting to offer active management, might actually invest the vast majority of a client’s funds in a way that mimics or tracks the market benchmark. A small proportion is then put into highly speculative investments. The portfolio is thus certain to return something close to the market benchmark, and generate the management fee, but with possibility of an outsized return that periodically generates performance fee and, with the right spin, sufficiently satisfies the client’s desire for success.

However, many active fund managers have an unjustified confidence in their ability to beat the market. And when they find themselves in a losing position, with serious risk of being terminated by the client, they can behave in ways that explicitly put their own interests in avoiding termination, or maximizing fee revenue before they are terminated, ahead of the client’s own interests. It is the further losses to the client from this “rogue” behaviour that cannot reasonably be disclaimed away as the reasonable risk of engaging an active fund manager.

The possibility of such rogue behaviour is not limited to active fund managers acting for private clients. It is just one of the many manifestations of the principal-agent problem that characterises the modern financial system. Economist John Kenneth Galbraith coined a new term – “bezzle” – to describe the extreme case.

To the economist embezzlement is the most interesting of crimes. Alone among the various forms of larceny it has a time parameter. Weeks, months or years may elapse between the commission of the crime and its discovery. (This is a period, incidentally, when the embezzler has his gain and the man who has been embezzled, oddly enough, feels no loss. There is a net increase in psychic wealth.) At any given time there exists an inventory of undiscovered embezzlement in — or more precisely not in — the country’s business and banks. This inventory — it should perhaps be called the bezzle — amounts at any moment to many millions of dollars.vii

The time parameter that characterizes Galbraith’s bezzle is not the criminal’s hope to escape discovery of their crime for as long as possible. Rather, its economic significance is that it is a period in which the embezzler’s principal has a false understanding of both its true financial position and the risk of leaving the embezzler in its position of trust. The risk to the principal is that the embezzler’s criminal acts continue, and the principal suffers further and more damaging losses, before the theft is discovered and the bezzle ended.

Unlike the bezzle, rogue behaviour by an active fund manager does not necessarily begin with anything illegal or even actionable per se. Charlie Munger called this kind of circumstance a “febezzle”, for “functionally equivalent bezzle.”viii However, the subsequent risk to the client is still effectively the same.

For so long as the client remains unaware of the true state of its portfolio the manager retains the possibility that losses or underperformance, that would otherwise see it terminated, can be won back before they are discovered. And the manager, unlike the client, now has nothing further to lose. Its incentive now is to risk the client’s portfolio in a way that gives it the possibility of the greatest gain in the shortest possible time. But such a strategy inevitably offers an equal prospect of catastrophic further loss for the client.

The Martingale strategy

The ultimate danger to the client is that the rogue manager adopts a doubling — or more formally, a Martingale – strategy. This originated (and continues today) as a gambling system, concisely defined in the Oxford English Dictionary as:

A gambling system of continually doubling the stakes in the hope of an eventual win that must yield a net profit.

The risk, of course, is that the gambler runs out of capital before it can win back its accumulated losses.

Private clients are not the only ones at such risk from their agents. Banks have long been aware of the risk posed by their employee-agents who are given discretionary control of bank capital to trade in financial markets. The original “rogue trader” was Nick Leeson, whose desperate Martingale strategy brought down his employer Barings Bank — one of the most venerable of British institutions – in 1995. Leeson’s own words provide a compelling insight.

I was well down, but increasingly sure that my doubling up and doubling up would pay off … This is gambling at its simplest. If you double up you, you halve the amount the market needs to turn for you to make your money back, but you double the risk.ix

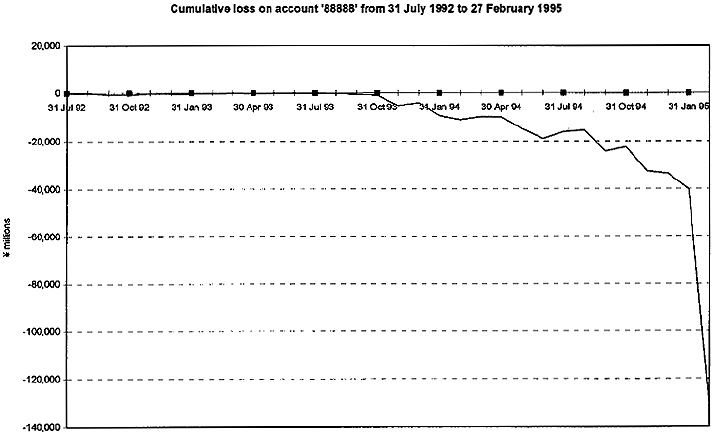

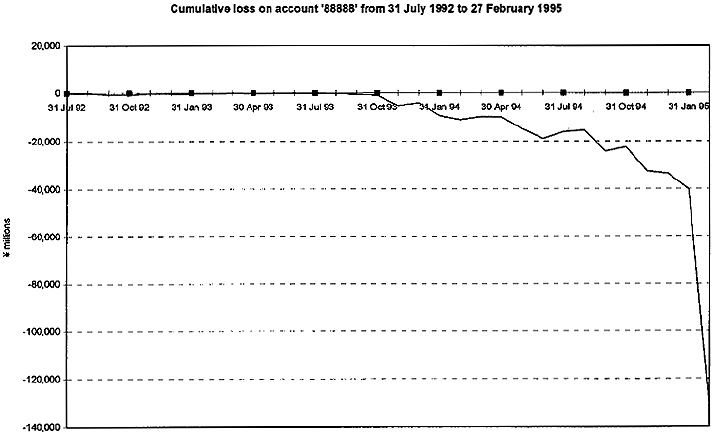

The following chartx, from the official Bank of England report, shows the losses on Leeson’s hidden trading account over time. The exponential rise in losses leading up to insolvency is the unmistakeable signature of a failed Martingale strategy.

But even before Nick Leeson banks had been more or less alert to rogue trading. And they now all have in place systems requiring the separation of trading, settlement and reporting, so that any unauthorized trading can be discovered immediately it happens. This means that rogue trading in banks is typically characterised by a level of sophisticated fraud and, often, collusion. Transactions, accounts and position reports must be falsified to bypass those systems. In Nick Leeson’s case he used his senior position to keep a secret trading account in which he buried his rogue trades and losses. Once discovered, the falsification itself is usually sufficient for criminal convictions to be secured against the trader.

In most cases, however, the active fund manager of a private client will not be subject to anywhere near the same degree or sophistication of oversight. This means a rogue manager may be able to engage in a Martingale strategy without resorting to the documentary fraud that would otherwise be direct evidence of fraudulent behaviour against its client’s interests. The manager may need to do no more than keep silent to its unsophisticated and unsuspecting client in order to continue its rogue behaviour.

Counsel should not overlook, however, that silence can still support a strong inference of rogue behaviour. Evidence that a manager selectively reported good news to its client while failing to report bad news, or evidence that a previously established pattern of communication between manager and client changed concurrently with the commencement of the alleged rogue behaviour, may be persuasive. Alternatively, a rogue manager may have taken advantage of its client’s lack of financial sophistication to explain away objectively bad news. Expert evidence — or even just relentless cross-examination – may dissect the financial jargon often adopted by rogue managers in their interactions with trusting private clients.

Bad luck

Counsel for the client may face another evidentiary challenge. While the casino gambler engages in a Martingale strategy by doubling and doubling the size of its stake, and a rogue trader like Nick Leeson doubled and doubled the absolute size of his unhedged derivatives positions, the manager of a private client portfolio will typically have its client’s funds fully invested at all times. This means that adoption of a Martingale strategy by a rogue manager will instead take the form of doubling and doubling the risk to the client’s invested capital. Proving that the manager substantially increased risk, even though the overall amount invested remained constant, may be more difficult than proving a trader dramatically increased the absolute size of its positions.

A manager accused of causing catastrophic loss by doubling and doubling the risk to the client’s portfolio will inevitably counter that its actions were within its discretion and that the adverse outcome was just extremely bad luck. This is the critical evidentiary issue. The client must prove the alternative, that the manager deliberately acted to increase the risk to the portfolio in its own and against the client’s interests, and that the catastrophic loss was in fact a reasonably foreseeable outcome of those actions.

Sometimes the assertions of bad luck are obviously untenable. In 2009 Andrew Haldane, then the Executive Director for Financial Stability at the Bank of England, considered an example from the global financial crisisxi. He quoted the Chief Financial Officer of the investment bank Goldman Sachs, David Viniar, who claimed that the large falls in the market prices of AAA-rated securities in August 2007 were such bad luck as to have been effectively unforeseeable. Viniar said:

We are seeing things that were 25-standard deviation (sigma) moves, several days in a row.

Haldane put that claim, which was based on Goldman Sachs’ internal risk model, in context. He observed that:

… assuming a normal distribution, a 7.26-sigma daily loss would be expected to occur once every 13.7 billion or so years. That is roughly the estimated age of the universe.

A 25 sigma event would be expected to occur once every 6 x 10124 lives of the universe. That is quite a lot of human histories. When I tried to calculate the probability of a 25-sigma event occurring on several successive days, the lights visibly dimmed over London and, in a scene reminiscent of that Little Britain sketch, the computer said “No”. Suffice to say, time is very unlikely to tell whether Mr Viniar’s empirical observation proves correct.

Fortunately, there is a simpler explanation — the model was wrong.

The relevance of Goldman Sachs’ model is that it would have been used by the bank and banking regulators as the primary measure of the risk the bank was taking, and thus the amount of expensive reserve capital it needed to set aside against that risk to ensure its continued solvency. That governments everywhere had to bail out their banks as a result of losses incurred during the global financial crisis can be traced directly to the widespread failure of such models. But that the global financial crisis marked the end of a period in which banks reported phenomenal returns on capital — with commensurately large rewards for their traders and management – suggests that the models’ massive understating of risk may not have been entirely inadvertent.

Analysis like Haldane’s – especially when combined with evidence of strong incentives for rogue behaviour – can be compelling to a court that is well used to deciding between inconsistent, competing explanations of events on the balance of probabilities.

Furthermore, and unlike a bank, the apparently rogue manager acting for a private client is very unlikely to have even engaged in any formal risk modelling or assessment of its strategy ex ante. This can cast serious doubt on the manager’s credibility when it subsequently offers up modelling that purports to support its self-serving claims that the losses complained of were just bad luck.

Risk

The risk to a client’s portfolio is a combination of two factors. First, the potential magnitude of changes in the prices or payoffs of the individual financial assets that comprise it. And second, the weighting and combination of those individual assets in the portfolio.

Consider the most common form of financial asset in which private clients invest, shares listed on a public exchange.

The maximally risky share is that of a company on the cusp of insolvency. The current price of such a share will not reflect an estimate of the true value of the company’s operations but rather some mid-point between its divergent value in the two possible alternative states. If the company becomes insolvent its shares will be worth zero. If it is in fact viable and survives, then its shares will be worth some significantly higher amount. Buying such a share is, economically, far closer to the binary, all-or-nothing gamble on the roulette wheel than to an ongoing investment in a long-term business.

But unlike its direction, the expected magnitude of future changes in the price of an individual share — the risk of that share at any point in time – can properly be the subject of evidence. There is no reason a court should not accept expert or other evidence as to the risk of a share at a point in time where that evidence has an objective basis in publicly-available, contemporaneous information such as company credit ratings, financial statements, market disclosures and even press reports.

The effect of portfolio composition on risk is self-evident. If the portfolio were invested entirely in a single highly risky share, then the downside risk to the client – but the upside opportunity for the rogue manager – would be of an entirely different order than if only a small fraction of the portfolio were invested in that share and the remainder invested in a diversified set of low risk shares. So risk falls on a spectrum, and the manager’s formula for increasing the risk of a client’s portfolio is conceptually quite simple. Increasing portfolio risk is just increasing the concentration of the portfolio in increasingly risky shares.

The clearest evidence of increasing risk will be an accounting model that recreates the evolution of the client’s portfolio through time, mapped against expert evidence of the risk of the component assets of that portfolio. And evidence that increasing risk correlated with increasing portfolio losses will, at least in the absence of a direct admission, be nearly the best evidence a client can bring against its rogue manager.

Conclusion

This short paper can do little more than set the scene, but its thesis might nevertheless be reduced to a useful set of propositions.

- A mandate to actively manage a client’s portfolio, even if subject to the standard disclaimers, does not give the manager carte blanche. Not all client losses can be justified as the reasonable manifestation of the risk of active client management.

- Given the nature of active management, the incentives of a client and its active manager are rarely aligned. It is often — almost inevitably – in the manager’s interests to maximize the risk to the client’s portfolio, against the client’s interests.

- The level of trust and lack of knowledgeable oversight that characterizes the typical relationship between the active manager and its private client means that the manager may have easy opportunity, in addition to incentive, to put its interests ahead of its client’s.

- The private client may not discover and terminate the rogue actions of its manager until a substantial part — or even all – of its capital has been depleted.

- Nevertheless, diligent analysis by experts and counsel can uncover an often surprising amount and quality of evidence that losses are due to the deliberate breach of fiduciary duty by the active fund manager and not mere bad luck.

William Wildi

i Barrister, member Bar Association of Queensland; PhD in finance; formerly Vice President, Bank of America NT&SA; formerly Principal Adviser, KBC Bank NV.

ii Financial Times. September 4, 2015.

iii For a summary of the most recent global research by Standard & Poor’s see the Financial Times online, March 20 2012, “86% of active equity funds underperform” by Madison Marriage.

iv “The General Theory of Employment, Interest and Money.” John Maynard Keynes. First published 1936. Chapter 12, Part V.

v See “Asset Management Fees and the Growth of Finance”. Burton G. Malkiel. Journal of Economic Perspectives — Volume 27, Number 2 — Spring 2013 — pp 97-108

vi [2014] EWHC 4268 per Mr Justice Walker at [172] — [181]

vii “The Great Crash: 1929”. JK Galbraith. First published 1955.

viii Talk of Charles T. Munger to breakfast meeting of the Philanthropy Round Table, 11 October 2000.

ix “Rogue Trader”. Nick Leeson. Sphere, 1996.

x “Report of the Board of Banking Supervision Inquiry into the Circumstances of the Collapse of Barings.” Ordered by the House of Commons to be printed 18 July 1995. p 56

xi “Why banks failed the stress test.” Speech by Andrew G Haldane at the Marcus-Evans Conference on Stress-Testing, London, 9-10 February 2009.