- A key question that investment markets are trying to answer is, have interest rates peaked and when will they fall?

- Central banks including the RBA are signalling that interest rates have peaked or are close to that point.

- Adding duration (bonds) can be an effective hedge to falling interest rates and other risk assets.

- For many investors this is an unfamiliar asset class however there are now many options available to retail investors.

- Current conditions suggest that adding duration is worth considering.

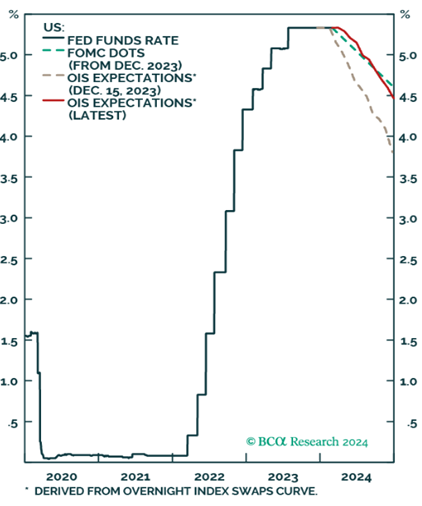

Interest rates set the price for credit which is a main determinant for economic activity and provides an opportunity cost for other investments such as, equities and property. US and Australian fixed interest markets are pricing in interest rate cuts later this calendar year. Refer Graph 1.

Since mid-2022 investments linked to the cash rate have produced strong income returns as the RBA cash rate increased from 0.10% to the current rate of 4.35%. The share market as measured by the ASX 200 increased by ~13% over this period. Similarly, the US Fed funds rate has increased from near zero% to the current 5.25% and the share market as measured by the S&P500 increased by ~26% over the same period.

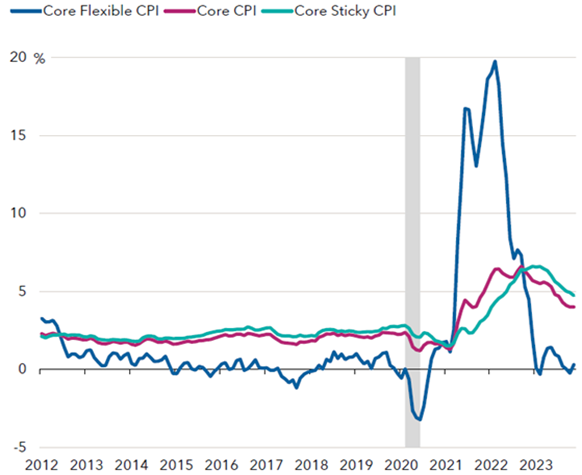

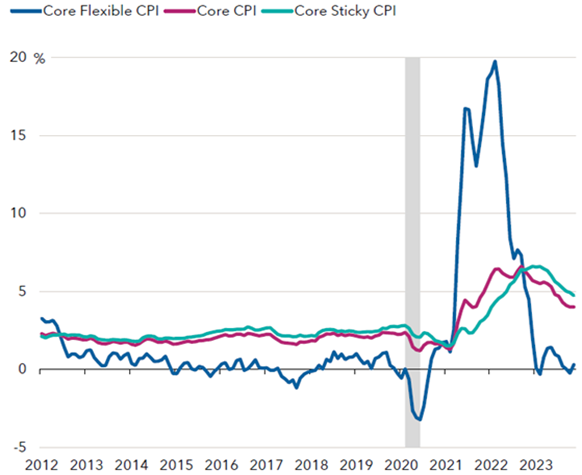

Graph 1: Inflation is moderating, particularly in the US.

Source: Capital Partners

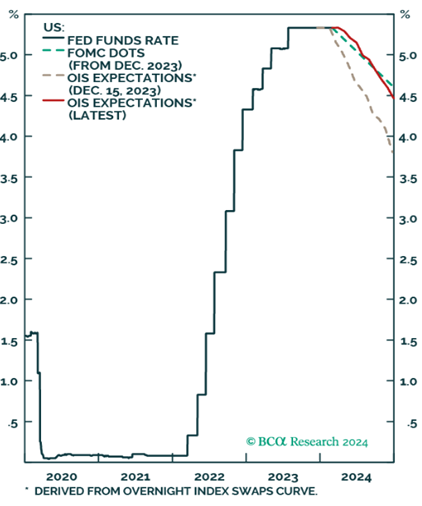

Graph 2: Expected Trajectory of US interest rates

Source: BCA Research

How low will they go?

At the March US Federal Reserve meeting, the Federal Reserve Chair made it clear that inflation holds the key to Fed policy. Whilst no commitment was made on when or how quickly the Fed will ease, he signalled that any shift in policy would likely be modest. The Fed’s decision will largely hinge on how quickly (core) inflation returns to its 2% target.

Many economists expect core PCE inflation to drop below 2% by mid-year. Accordingly, the US economy appears to be nearing an inflection point. Refer Graph 2.

Bond fund managers, Janus Henderson suggest that the RBA cash rate interest rate will fall to ~3.0%. Whilst other forecasters like BCA Research believe that the US Fed funds rate needs to fall to ~2.5%. We will ultimately learn the answer with hindsight, however what it is generally agreed is the trend i.e. that interest rates will need to fall over the medium term.

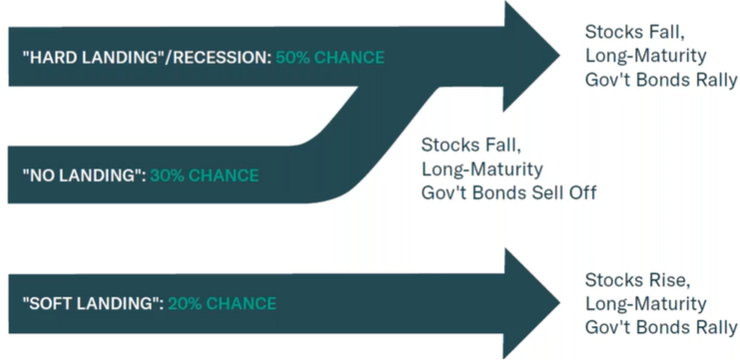

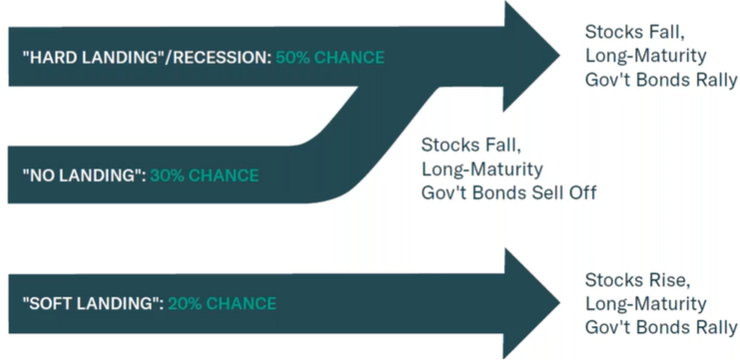

There are many scenarios forecasting future economic growth these tend to differ in the speed and depth by which interest rates need to be changed to restore economic stability and they have differing implications for investment markets. Refer Diagram 1.

Diagram 1: Economic Scenarios – predicted odds and investment implications

Source: BCA Research

There are many signals about tight monetary policy and its impact, including increasing loan delinquencies and declining growth in new loans, as examples. Contrastingly, employment has remained strong and buoyant share markets both here and in the US. Share markets are trading at record highs, driven in part, by the prospect of future rate cuts and excitement around the potential of Artificial Intelligence (specifically Generative AI) which has boosted the profits and share prices of the 7 largest technology companies.

Interestingly, the earnings of the remaining 493 S&P 500 companies fell in the December quarter by 11%. If this trend continues then companies will likely retrench jobs, and this will lend more weight to the Federal Reserve cutting funds rate.

So, is now the time to add duration (bond) exposure?

Investing in bonds (long dated debt securities with fixed interest payments/coupons) is well practiced in the northern hemisphere where there are broad/diverse and liquid bond markets. Investors can profit from changes in interest rates by holding debt securities with longer maturities and higher yields. As interest rates fall the capital value of these securities increase recognising the high value of interest generation, this can compensate for the loss of income from cash deposits or floating rates securities.

However, not all bonds are equal, so in more uncertain times investors are attracted to sovereign (Government issued) debt as opposed to bonds issued by companies where there is a higher probability of default on either the payment of income or the return of capital.

What is duration?

Duration is an assessment of the price volatility of a fixed-income security. Simplistically, the higher the duration the greater likelihood that the value of a bond (or bond portfolio) will fall as interest rates increase. For example, if a bond has a duration of 5, this implies that a 1% change in interest rates +/- will produce an opposing change in the capital value of that bond i.e. if interest rates fall the capital value of the bond will increase.

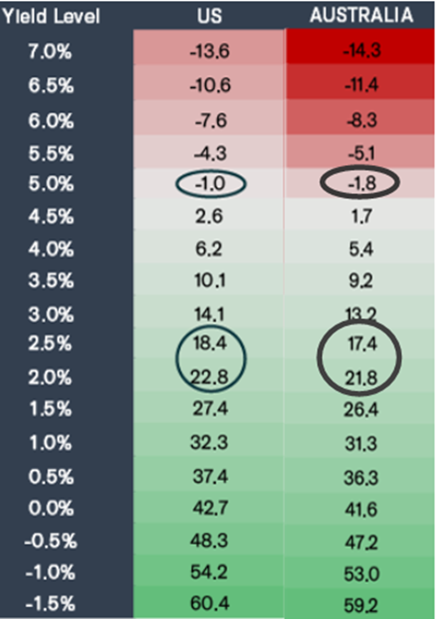

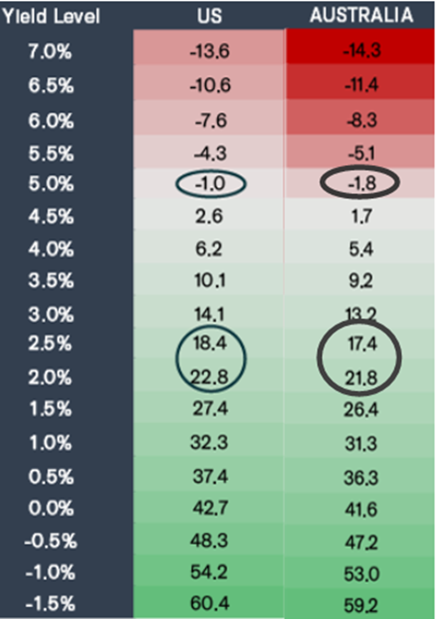

Table 1 below illustrates the 1-year expected return on 10-year Government bonds in both the US and Australia at varying interest rates.

Australian 10-year Govt bonds are trading at 4.05%. If it were to increase to 5.0% this would result in a loss of ~1.8%. Similarly, if the 10-year Govt bond were to fall to 2.5% the value of a 10-year Govt. bond would increase by ~17.4%. Understandably, yields on cash deposits and all floating rate securities would similarly fall in line with the cash rate assuming their yields move in the same direction.

Table 1: Implied 1 year (%) returns on a 10yr Govt Bonds based on differing yield levels

Source: BCA Research

Are we there yet?

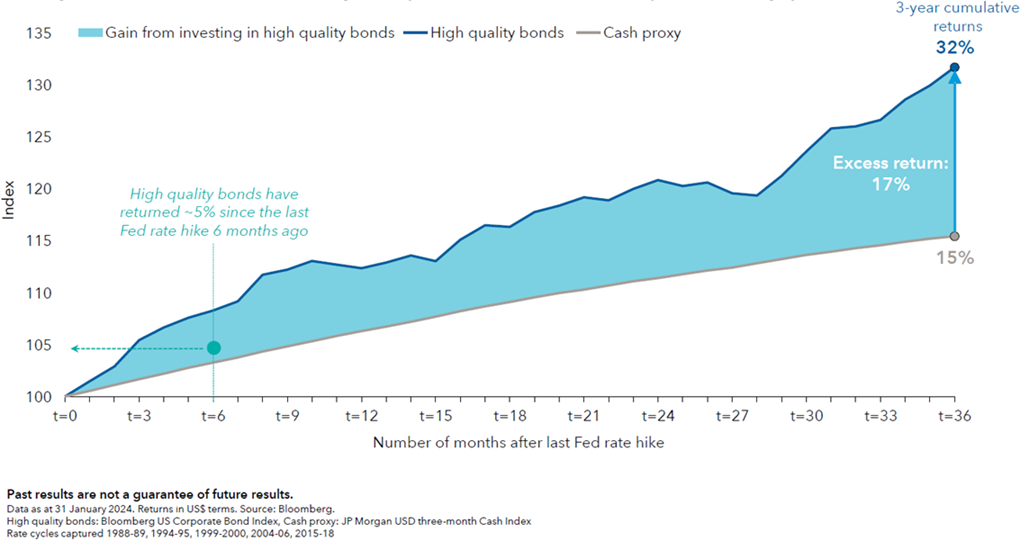

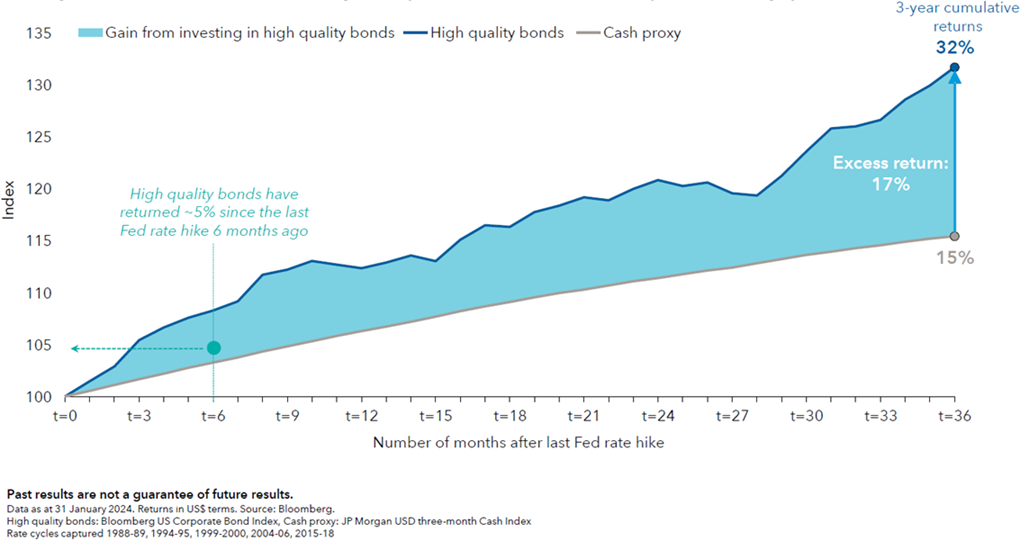

History has shown the best time to enter the bond market (purchase Government issued debt) is within 4 months of the peak in interest rate tightening. Given we are now 21 months from the first rate tightening in Australia and 24 months in the US, economies are nearing an inflection point. Graph 4 illustrates the average cumulative return from investing in bonds at the peak of Fed rate tightening cycles.

This then builds a case for adding exposure to Government bonds in diversified portfolios to hedge against future reductions in interest rates.

Graph 3: Historically rate cuts are positive for bonds

Source: Capital Group

How to hedge against falling interest rates?

A decade ago, investing in fixed interest particularly bonds was the province of institutional investors such as industry and retail/super funds and professional investors as the minimum deal size was $500,000. Thanks to the development of specialist funds and exchange traded funds (ETFs) and fund platforms access to this asset class is within the reach of retail investors. Many offerings are both liquid and cost effective.

If you would like to learn more on how specialised bond funds and exchange traded funds (ETFs) can be employed to hedge against the effects of falling interest rates, please let us know.

Threats to this view

- Exogenous events such as escalation in military activity or another pandemic.

- A significant increase in central bank cash rates in reaction to persistent or rising inflation.

Andrew Fleming BBus MBA GradDip App Fin & Inv MSIAA Investment Adviser | StockbrokerAuthorised Rep: 000466078Direct: 07 3152 0604Email: andrew.fleming@morgans.com.au

Michael Börjesson BBus (Econ) FFin CFP® Financial Adviser | Authorised Rep: 000466077Direct: 07 3152 0606Email: michael.borjesson@morgans.com.au

Sources: BCA Research, Capital Partners, Janus Henderson, Morgans Financial, RBA.

Disclaimer: The information contained in this report is provided to you by Morgans Financial Limited as general advice only and is made without consideration of an individual’s relevant personal circumstances. Morgans Financial Limited ABN 49 010 669 726, its related bodies corporate, directors and officers, employees, authorised representatives, and agents (“Morgans”) do not accept any liability for any loss or damage arising from or in connection with any action taken or not taken on the basis of information contained in this report, or for any errors or omissions contained within. It is recommended that any persons who wish to act upon this report consult with their Morgans investment adviser before doing so.

Source: Capital Partners

Source: Capital Partners

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: Capital Group

Source: Capital Group