The Government has updated its approach to the contentious proposed Division 296 Tax.

The original proposal introduced an additional 15% tax on superannuation earnings that related to a member’s balance in excess of $3,000,000. The limits were not indexed, and the calculation method (somewhat controversially) was based on a member’s Total Super Balance (TSB) which included the assessment of unrealised capital gains.

The updated proposal is more targeted, taxing only realised earnings above indexed thresholds, with higher rates for larger balances. It removes the controversial taxation of unrealised gains, while potentially simplifying the required reporting and administration, especially for SMSFs.

The first tax year for these changes is expected to be 2027/28. The legislation still needs to pass through both houses of Parliament, but that passage should be substantially easier given the proposed changes.

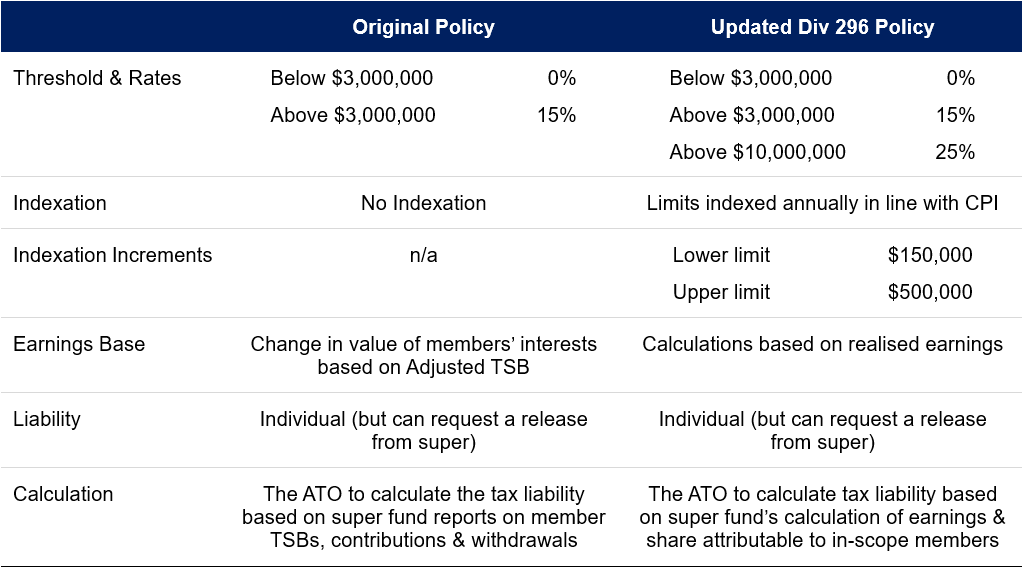

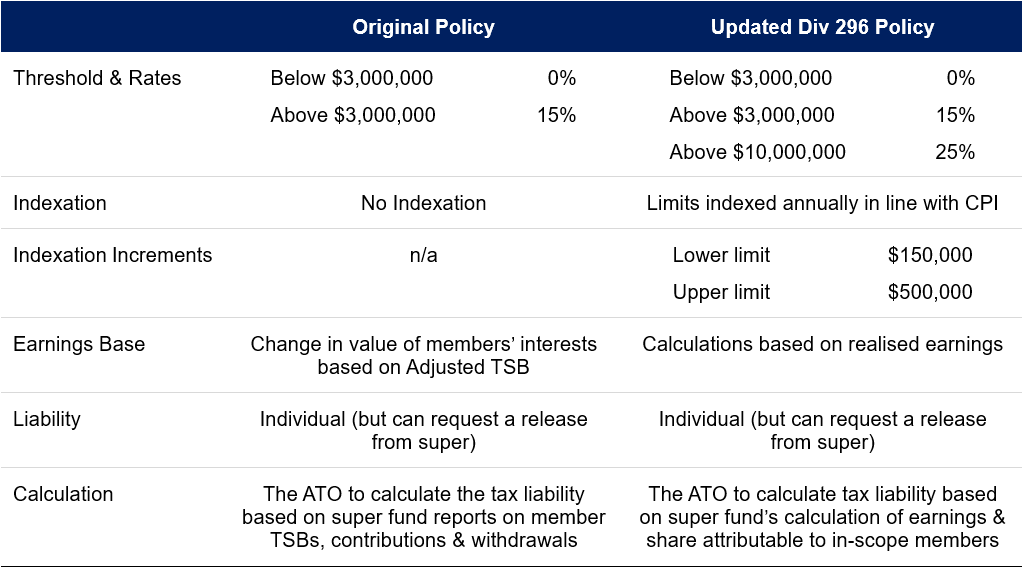

Table: Comparison of Original and Updated Div 296 Proposals

The substantial elements are:

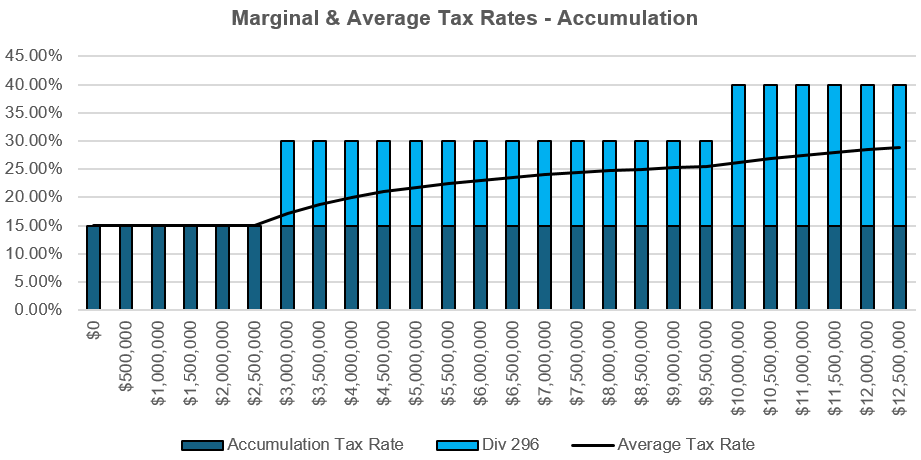

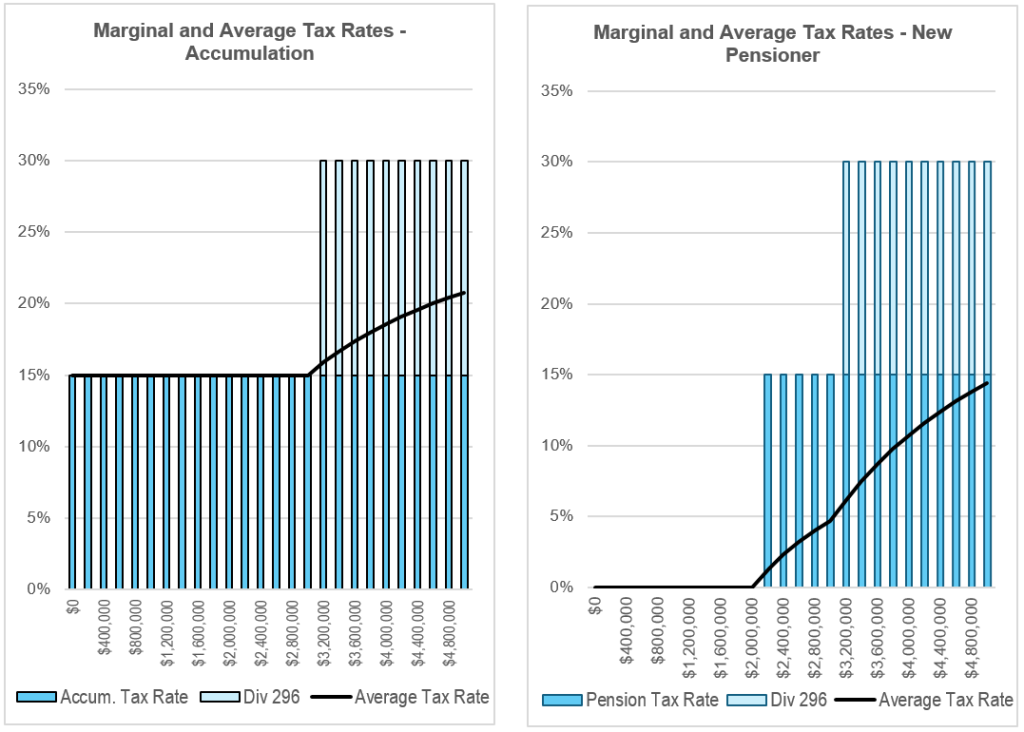

- A new tier has been introduced to increase tax on earnings from member balances above $10,000,000:

- No additional tax where a member’s balance is below $3,000,000.

- 15% additional tax on earnings from balances between $3,0000,000 and $10,000,000. This makes the effective tax rate 30% for members in accumulation.

- 25% additional tax on earnings from balances above $10,000,000. This makes the effective tax rate 40% for members in accumulation.

- The tax is applied to the member’s super earnings based on the proportion of their member balance above each threshold.

- The new limits are now indexed to CPI, which is consistent with a range of other super measures.

- The tax is applied to taxable income, rather than the change in value of the fund. This removes the controversial taxation of unrealised gains.

- The responsibility for calculation of the tax liability will return to the ATO.

- The ATO will identify members with balances above the thresholds.

- Super funds must report realised earnings for these members to the ATO.

- Similar to the application of Div 293 (additional tax on super contributions for higher income earners), the tax liability is levied to the individual, but they can request a release from their super fund to pay the liability on their behalf.

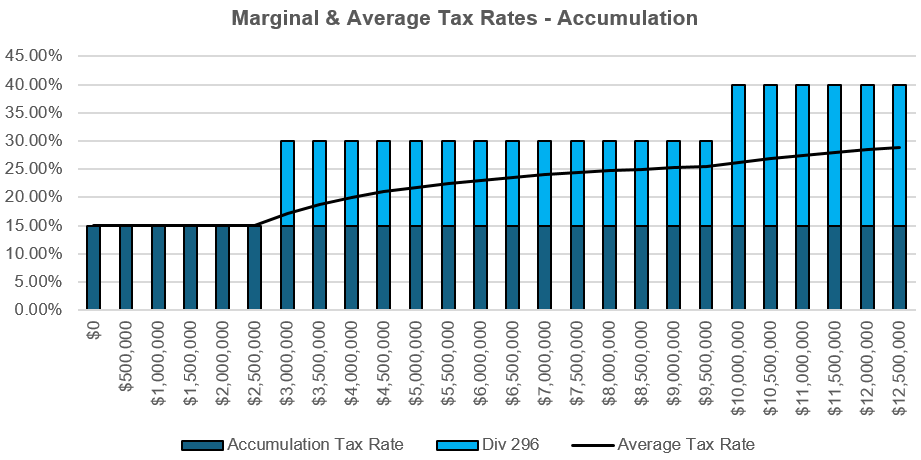

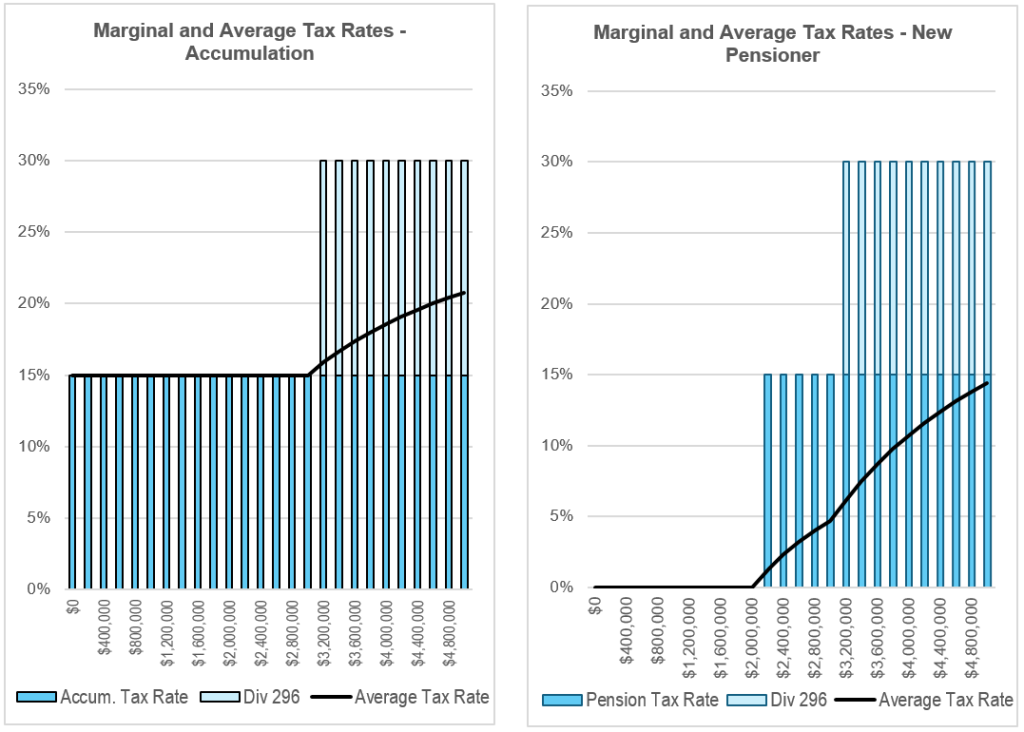

Figure 1: Impact on Accumulation Members

ConsiderationsInvestors should consider the degree to which they still use super as part of their investment and retirement strategies. For investors with less than, or nominally more than $3,000,000 in super, the changes will be immaterial and unlikely to justify the establishment of new, separate investment structures. Indexation will increase the level where the tax applies and super will remain the most effective investment structure providing savings discipline, asset protection, and tax efficiency.

For investors with substantially more than $3,000,000 in super, and who are at or near their preservation age, establishing separate tax structures to hold these assets has increased appeal. Trusts remain attractive as an alternative investment structure, but with substantially less tax concessions for balances below $3,000,000. The operation of and taxation of trust earnings remains an area of interest and potential to the ATO.

Corporate structures represent an interesting alternative to investors with large balances and a long investment horizon. Corporate tax rates are relatively stable at 30% and corporate structures are well understood. Investing through a corporate structure avoids some of the complicated issues that can arise with the taxation of super death benefits. We do need to be conscious that companies will ultimately distribute their profits as dividends, which are taxed at the shareholders’ marginal tax rates.

Investors should continue to consider the equalisation of super benefits. We have long been advocates of pursuing more equal balances between clients’ super balances within their family unit, through:

- Splitting member contributions each year.

- Directing non-concessional contributions to a low balance member.

- Conducting withdrawal and re-contribution strategies at, or shortly after, retirement (which can have the added benefit of improving death benefit taxation).

Historically there has been a significant transfer of wealth within super upon the death of a spouse. In 2017 this process was complicated with the introduction of Transfer Balance Caps (which are specific to each member). Div 296 further complicates that process. There is likely to be a cohort of investors who are impacted as one member of a couple passes, and the family’s super investments are consolidated in a single member account. More detailed planning will be required at this challenging point in people’s lives.

ConclusionIt is estimated that approximately 80,000 people have a super balance greater than $3,000,000, and only 10,000 have a balance greater than $10,000,000. We expect this will grow as member balances compound, and as members of a couple pass and consolidate assets to a single fund member.

For the vast majority of investors, the tax concessions available through super means this remains the most effective vehicle through which to accrue retirement savings. For a member with a $4,000,000 super balance, the average rate of tax is 18.57% for a member in accumulation and just 10.71% for a member in pension phase.

The alignment of the marginal effective tax rate on balances over $3,000,000 with the corporate tax rate makes corporate structures more appealing to investors with this level of capita. This is particularly relevant for those with multi-generational investment horizons and the ability to effectively distribute dividends.

The punitive level of tax for balances over $10,000,000 is well above the corporate tax rate and clearly designed to discourage members accumulating balances above this level.

Of course, we are happy to discuss the impact with affected or interested barristers.

Michael Börjesson BBus (Econ) FFin CFP® Financial Adviser | Authorised Rep: 000466077Direct: (07) 3152 0606Email: michael.borjesson@morgans.com.au

Andrew Fleming BBus MBA GradDip App Fin & Inv MSIAA Investment Adviser | Stockbroker | Authorised Rep: 000466078Direct: (07) 3152 0604Email: andrew.fleming@morgans.com.au

Disclaimer: The information contained in this report is provided to you by Morgans Financial Limited as general advice only and is made without consideration of an individual’s relevant personal circumstances. Morgans Financial Limited ABN 49 010 669 726, its related bodies corporate, directors and officers, employees, authorised representatives, and agents (“Morgans”) do not accept any liability for any loss or damage arising from or in connection with any action taken or not taken on the basis of information contained in this report, or for any errors or omissions contained within. It is recommended that any persons who wish to act upon this report obtain personal advice before doing so.